House View: Southeast Asia’s Tech and Venture Sectors Rekindles Cautious Optimism Amidst the Thaw

The term “funding winter” has permeated discussions from panels at tech conferences to casual cafe conversations over the last twelve months. The fundamental question pertains to venture capital liquidity constraints induced by prevailing macroeconomic and political challenges. Will these constraints persist in Southeast Asia, or can we anticipate a resurgence in funding levels to reach heights achieved in 2021? During that year, the tech sector in the region witnessed a historic high, with investments exceeding the unprecedented milestone of US$20 billion.

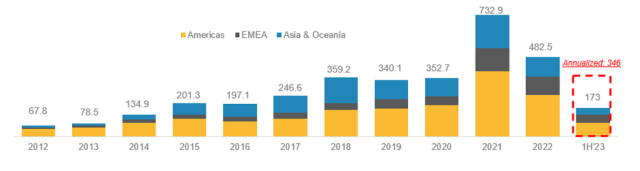

Let’s review the global funding trend over the past decade, encompassing venture capital investments into startups across the Americas, Europe, the Middle East, Africa, and Asia, including Southeast Asia. The chart below illustrates a consistent upward trajectory in funding from 2012 through 2022. Notably, 2021 emerged as an exceptional year, marked by an unprecedented surge in capital deployment with investments nearly 1.5 to 2 times higher compared to the preceding and subsequent years. As we approach the conclusion of 2023, it is important to acknowledge that the full-year funding figure is still awaiting final tallying. However, a preliminary estimate, based on a rough calculation, suggests that approximately US$340 billion may have been invested during this year. This would represent a dip from 2021-22 but on par with 2018 through to 2020 funding levels.

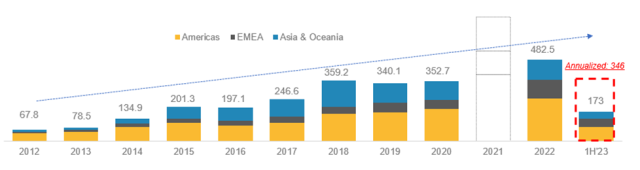

In retrospect, the venture capital landscape witnessed an unprecedented bull run in 2021, characterized by a substantial influx of investment dollars from both corporate and venture tourist investors into the startup sector. If we were to eliminate the 2021 funding spike from the chart above and draw a trendline across the past ten years as shown in the chart below, a compelling narrative emerges. Over this period, invested capital has displayed a consistent and progressive growth pattern, expanding by a noteworthy factor of 5 to 7 times.

![]()

What sets this trend apart is the discernible shift in capital allocation, with an increasing proportion being directed towards the Asia and EMEA (Europe, Middle East, and Africa) regions. This transformation in the funding landscape signifies a fundamental reorientation of global investment priorities within the tech and venture sectors. The significant surge in investment activity in 2021, driven by both corporate and venture investors, underscores the industry’s dynamic evolution and its resilience in the face of economic challenges.

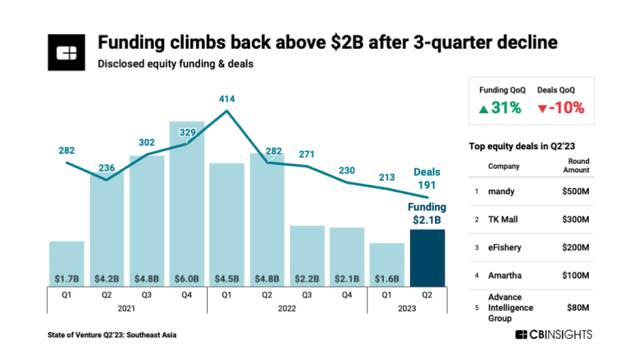

In the context of venture funding in Southeast Asia, the second quarter of 2023 saw a notable increase, reaching a total of $2.1 billion. It’s worth observing that despite the increase in total funding, the deal count was lower during this period. According to CB Insights, Indonesia emerged as the leading recipient of funding in the region during 2Q 2023, with its startups securing $1 billion, an extraordinary 233% surge compared to the preceding quarter. Singapore (a base for Southeast Asia startups) closely followed with $914 million in funding, although this represented a 15% decline quarter-over-quarter.

The past quarters also witnessed an uptick in exits within the Southeast Asian startup ecosystem. This was particularly evident in the increased number of M&A exits for the second consecutive quarter. In this evolving economic landscape, more tech companies are grappling with the challenge of managing their liabilities and raising funding. As a result, an increasing number of these companies are opting to pursue mergers with larger competitors as a strategic move to sustain their operations and keep their businesses afloat. Startups are adapting to the challenges posed by evolving market conditions, which may include increased competition, funding constraints, or changing investor sentiment. Mergers and acquisitions can offer a viable path forward for startups seeking stability and growth, while also presenting opportunities for larger companies to expand their market presence and capabilities in the region.

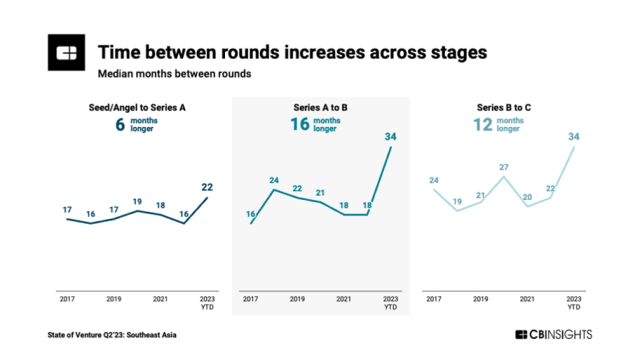

In the current funding landscape startups are facing the imperative of planning for an extended runway as the process of closing financing rounds has become considerably protracted. Notably, earlier-stage companies, ranging from Seed to Series A, are finding it necessary to allocate up to 2 years for fundraising, representing an increase from the 16-month average observed just a year ago. Meanwhile, statistics reveal that later-stage companies, specifically those at the Series B stage and beyond, experience even more extended timelines, with fundraising cycles stretching to as long as 34 months.

Several factors contribute to these extended timelines, with one significant reason being the heightened focus of global VCs nursing their existing portfolio companies. Many VCs have slowed down their pace of new investments, with some openly admitting that they have not committed to new deals over the past 12 months. This trend has particularly impacted fund deployment, which has contracted by 25-30% in the current year, especially in regions like Indonesia and at the Series B+ stage. However, VCs remain active in earlier-stage cycles, notably at the Seed and Series A stages.

Despite these challenges, there exists a prevailing sentiment of cautious optimism regarding the future. VCs believe they will gradually increase their investment activities toward the latter part of 2023 and into 2024, provided that macroeconomic conditions continue to improve and unforeseen disruptive events are avoided. In the midst of this downturn, industry insiders, like Oswald Yeo, CEO of recruitment startup Glints, underscore the resilience and growth potential of the Southeast Asian startup ecosystem. Across various industries and verticals, a positive outlook toward sustainable growth persists, with a significant percentage of surveyed companies (86%) expressing their intentions to continue hiring in 2023. This challenging period is also expected to cultivate the emergence of strong founders who can weather such adversity, building businesses that can withstand even the most challenging circumstances.

Tech IPO Window Resumes Business, But Not Wide Open

Despite these challenges, there are positive offshoots returning to the public markets with several high-profile IPO listings leading the charge, which hopefully would trickle down to the private markets. The month of September 2023 witnessed a series of notable IPOs, underscoring the enduring interest in technology-driven firms seeking public equity. Among these, Arm Holdings plc, a Softbank-backed entity, stands out, with an IPO that initially valued the company at approximately $54.5 billion and at one point surging to nearly $72 billion. Arm Holdings specializes in the architecture, development, and licensing of high-performance, energy-efficient IP chip solutions, integral to the functioning of over 260 technology companies worldwide, including major smartphone manufacturers such as Samsung, Huawei, and Apple.

Another prominent tech IPO in the same period featured Instacart, a grocery delivery service, which, having been previously valued at $39 billion, debuted on the NASDAQ with a fully diluted valuation just surpassing $11 billion. Concurrently, Klaviyo, a marketing automation firm under the umbrella of Shopify, made its debut on the New York Stock Exchange, achieving profitability and obtaining a $9 billion valuation, substantiated by $345 million in raised capital.

Conversely, some startups have opted to defer their IPO plans. VNG Ltd, a Vietnamese internet company with backing from Tencent, chose to delay its $150 million U.S. IPO until 2024, citing the prevailing volatile market conditions. VNG was established in 2004 and hailed as Vietnam’s inaugural unicorn, operates across diverse sectors encompassing online gaming, payments, cloud services, and the preeminent Vietnamese messaging application, Zalo.

Singapore-based cancer diagnostics firm Mirxes has submitted an application to the Hong Kong Stock Exchange for an initial public offering, potentially becoming the first non-Chinese and non-Hong Kong-based biotech company to list under a specialized provision. This decision follows a $50 million Series D funding round, which ascribed a post-money valuation of approximately $600 million to Mirxes.

Industry analysis by PitchBook indicates a queue of nearly 80 IPO candidates including TikTok, Stripe, Discord and more who are lining up to go public. While there exists a discernible opening in the IPO window, investors are currently leaning toward a cautious stance for the remainder of 2023. Venture capitalists are advising their startups to consider deferring their IPO plans until interest rates have stabilized. The possibility of further interest rate hikes in the year, coupled with reduced expectations for rate cuts in 2024, could further influence market sentiment. Moreover, volatility in share prices for both Arm Holdings and Instacart underscore the necessity for prudence in the prevailing listing environment.

More Dry Powder Reason For Optimism In Thawing Of Equity Winter

In 2022, while the number of newly established funds experienced a decline, the total capital amassed by global funds reached an unprecedented pinnacle, totaling a staggering $162.6 billion. This achievement marked the second consecutive year in which capital inflows surpassed the significant milestone of $100 billion, defying challenging economic conditions.

According to DealStreetAsia’s 2Q 2023 report, Southeast Asian investors successfully raised an impressive US$3.72 billion in the first half of the year. Notably, the recent announcements have catapulted Southeast Asian venture capital firms beyond last year’s fundraising record of $4.14 billion. Pitchbook reported that the US largest public pension scheme, Calpers, which manages some $444 billion in capital, intends to increase its venture capital allocation by more than sixfold, from $800 million to $5 billion. These developments highlight a robust investor sentiment in the region.

Vertex Ventures, for instance, substantially exceeded its expectations by closing its fifth fund at a substantial US$541 million, surpassing its initial target of US$450 million. This achievement notably exceeded the US$305 million garnered for the firm’s previous fund, which concluded in 2019. Similarly, Monk’s Hill Ventures concluded its second fund at a remarkable US$200 million. Additionally, Singapore’s Temasek announced its strategic collaboration with the National University of Singapore and Nanyang Technological University Singapore, committing US$55 million to foster the commercialization of deep-tech ventures emerging from the research pipelines of these esteemed institutions.

The VC market landscape has undergone a notable transformation, shifting away from its traditional startup and founder-centric ethos to one that is more favorably inclined toward investors. Several key drivers underpinning this transformation include the widening gap between capital demand and supply, coupled with a discernible decrease in valuation upticks across various developmental stages.

In light of this evolving landscape, VCs are poised to continue deploying their capital; however, the terms of these deals are expected to skew more positively towards investors. Consequently, entrepreneurs are faced with the imperative to refine their business models and present a meticulously delineated roadmap toward achieving cash breakeven and profitability. Those entrepreneurs who can exhibit robust unit economics and pragmatic growth projections will find themselves in the most advantageous position when competing for coveted VC investments.

Developments In The Venture And Private Debt Sector

Smart money continues to flow into private debt, drawn to the favorable risk-adjusted returns and with plenty of headroom for future growth. The collapse of Silicon Valley Bank (SVB) in March 2023 did not dampen the appetite for venture debt, a subset of private debt. Banks across the world have jumped into direct lending to startups, seizing opportunities in a post-SVB era. HSBC picked up some of SVB’s assets and its team and went on an aspirational strategy to become the next SVB. HSBC announced a $3 billion Hong Kong/China fund and separately a $105 million (RM500 million) Malaysia New Economy fund that will be dedicated to providing high-growth, innovative companies with a suite of tailored debt solutions in their respective jurisdictions. In Japan, Aozora Bank announced its third $60 million (¥9 billion) venture debt fund for local start-ups, while MUFG launched two new venture debt funds worth $400 million for Japanese and European startups, reflecting strong funding demand as the market for initial public offerings remains dull.

BlackRock Inc estimates that between the end of 2018 and the end of 2022, the private credit market doubled in size from roughly $750 billion to $1.5 trillion. To further deepen its private credit offerings, BlackRock acquired Kreos, a provider of growth and venture debt in technology and healthcare in Europe and Israel who has committed around $5.6 billion in over 750 debt transactions, demonstrating strengthening investor demand for exposure to venture debt and private credit.

Venture Debt Dealflow

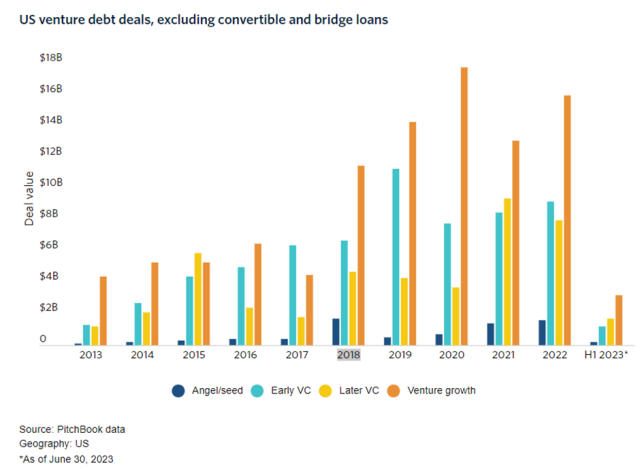

In the US across all stages, startups closed $6.34 billion across 931 venture debt deals in the first half of 2023, compared to $20.07 billion across 1,513 deals in the same period last year. The diagram below shows the debt committed to startups across different stage of development. While the debt commitment has reduced across all stages, it is more evident for early-stage startups. One possible reason could be the collapse of SVB who primarily operated in the early-stage market, sometimes lending to pre-revenue companies, while its new owner, First Citizen Bank, does not expect to step up to fill that void.

Debt capital remains in high demand among startups as companies turn to alternative financing. The number of new and repeat debt financing conversations has certainly increased. Lenders are however becoming pickier and seek more favourable covenant packages and warrant coverage, in addition to higher interest rates. Lenders also wants additional comfort that startups are on track to receive future investment and that their investors remain committed to the company. While lenders can benefit from a rise in interest rates, the converse is an increased loan repayment risk as increased cost of borrowing and tighter covenants means that borrowers need to operate within their means.

Funding Outlook For The Next Six To Twelve Months

The million-dollar question is how the rest of 2023 and 2024 looks like for the venture and tech sectors? Not to oversimplify things, there seem to be two groups of startups in the market currently: those that have raised funding in 2021/2022 (albeit at a high valuation) but that have adapted to the volatile market, conserved cash and growing sustainably; and another group that has continued to trailblaze growth but that has run out of funding and struggled to raise capital. Valuation expectation will need to be moderated and lenders are certainly witnessing an increase of queries for debt financing with or without new equity injection. In all certainty, entrepreneurs will need to start funding conversations much earlier in anticipation of the longer process.

Venture investors that take the brakes off and continue to invest in startups that have undergone business and capital rationalisation at an attractive entry point valuation may be capitalizing on being ahead of the herd with significant de-risking as the company has demonstrated added traction. The revival of startup funding over the next 6-12 months is intrinsically linked to several key factors reshaping the entrepreneurial landscape. As venture capital firms find themselves flush with more dry powder, they are eager to channel these resources into startups that have proven their ability to survive a major down cycle. This surge in available funding, combined with a slowly opening IPO market, creates a symbiotic relationship where startups have a clear path to exit strategies that appeal to investors. Moreover, startups are emerging from recent challenges as leaner and more efficient entities, well-equipped to maximize the capital they receive. This newfound efficiency not only instills confidence in investors but also ensures that the funding received is utilized effectively, ultimately fuelling the remarkable resurgence of the startup ecosystem.