This House View is contributed by Dave Richards, Managing Partner, Capria Ventures, Seattle, Washington, USA. Dave is an experienced investor in emerging markets with a focus on technology-enabled businesses across India, Southeast Asia, Latin America, and Africa. As an LP in Genesis Alternative Ventures, he brings over two decades of experience in venture capital.

Open-source breakthroughs are accelerating the rise of applied AI in Southeast Asia. As startups embed cutting-edge technology into fintech, agritech, edtech, and healthcare, investors have a rare window of opportunity to back high-growth startups before valuations soar.

For two years, affordability of AI technology has constrained emerging market startups, limiting some innovations in sectors primed for transformation. That bottleneck is disappearing fast. While global investments have centered on building AI’s backbone — foundational models, computer power, and regulation — Southeast Asia real AI opportunity lies in its application. Recent breakthroughs in open-source AI, led by players like DeepSeek and Alibaba, have dramatically lowered development and inferencing costs, allowing AI adoption to scale in high opportunity sectors like fintech, agritech, healthcare, and education.

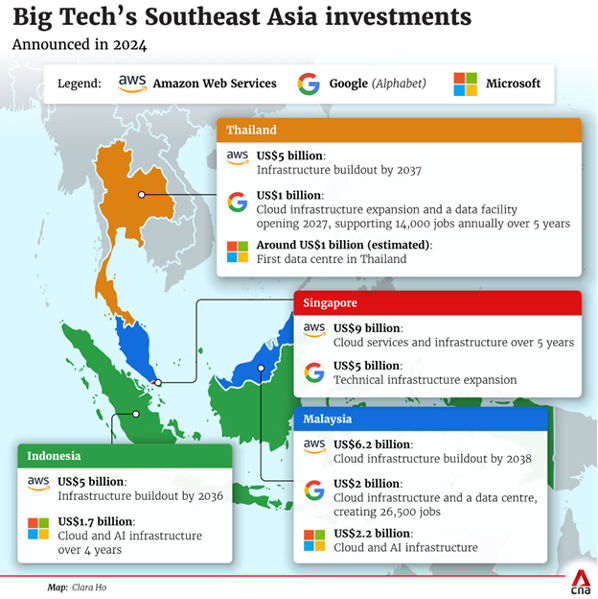

As cost barriers crumble, AI adoption is doing more than boosting efficiency — it’s unlocking new markets, driving inclusion, and fueling economic growth in ways few anticipated. Big Tech (namely Amazon, Google and Microsoft) has clearly identified the Southeast Asian market opportunities and committed to investing massively across Singapore, Malaysia, Thailand, and Indonesia to expand cloud infrastructure and data centres. The combined billions of dollars of infrastructure investment is set to catalyze Southeast Asia as a challenger for AI.

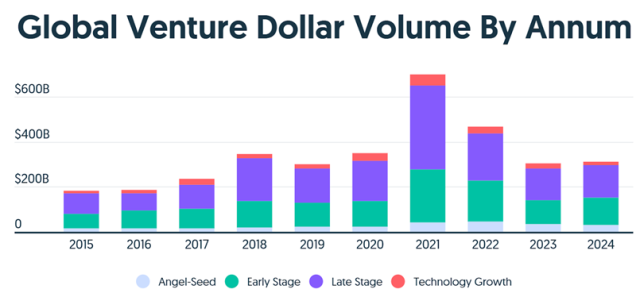

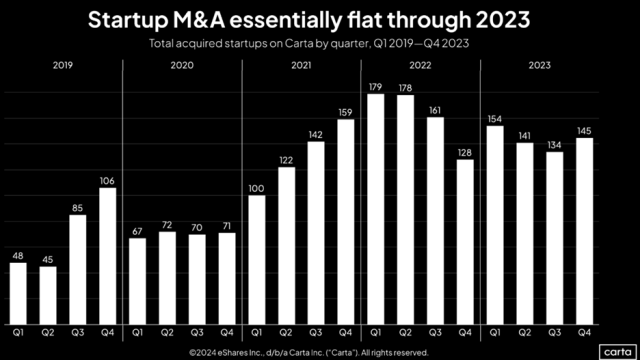

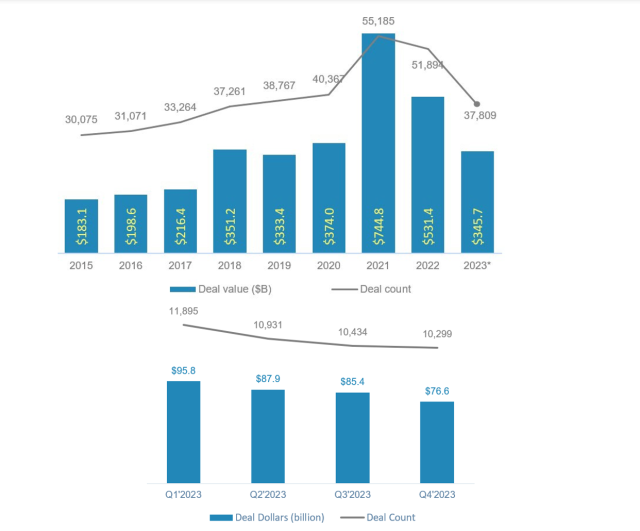

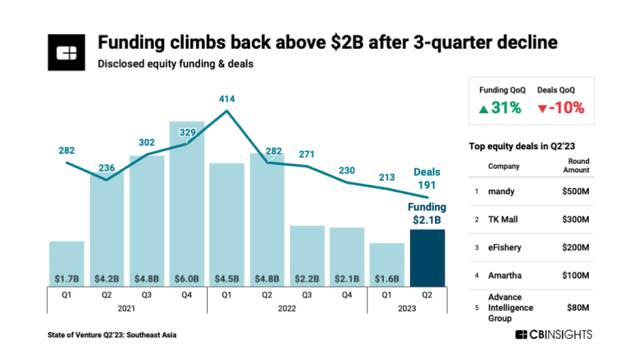

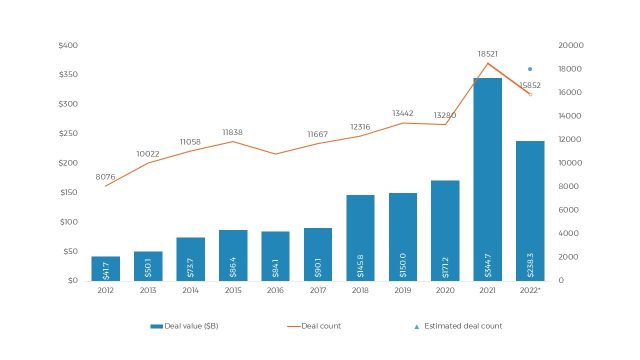

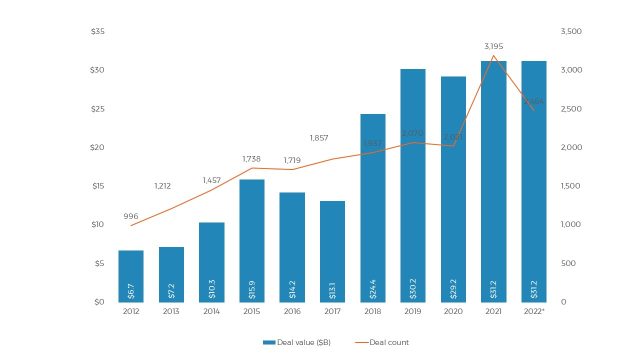

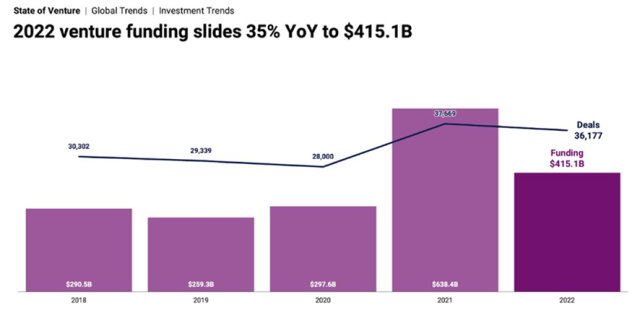

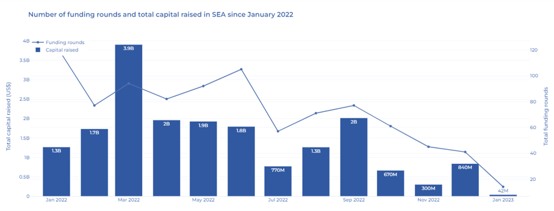

One out of every three VC dollars invested globally in 2024 went to an AI startup, reflecting a continued coalescence around the vertical that some investors fear is having a distorting effect on the market. Yet, venture funding for Southeast Asia’s AI startups lags behind broader Asia-Pacific trends, and investments in startups aggressively implementing AI capabilities in their tech stacks remain largely under the radar. Venture investment in South-east Asia’s young AI firms has hit just $1.7 billion so far in 2024, out of about US$20 billion for the Asia-Pacific region as a whole, data from Preqin shows. Only 122 AI funding deals have taken place in the region in 2024, versus the Asia-Pacific total of 1,845. This gap presents a rare window: companies once less investable are now scaling rapidly, demonstrating earlier profitability, and establishing defendable first-mover advantages.

Investors who recognize this untapped potential stand to benefit substantially as these startups bridge the AI implementation gap across Southeast Asia’s rapidly digitizing economies, which collectively represent a $300+ billion digital economy opportunity by 2025.

The Undervalued Applied AI Opportunity

While Southeast Asia’s “official” AI market is projected to reach $8.92 billion in 2025 – alongside India’s $7.8 billion and Africa’s $4.92 billion – these figures primarily reflect AI-driven software, hardware, and services. The broader economic impact of AI adoption in businesses remains vastly underestimated and unaccounted for.

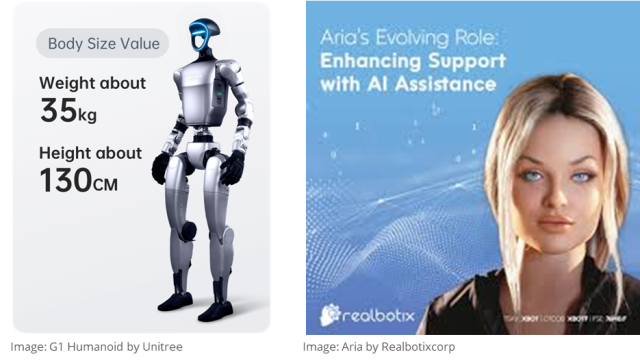

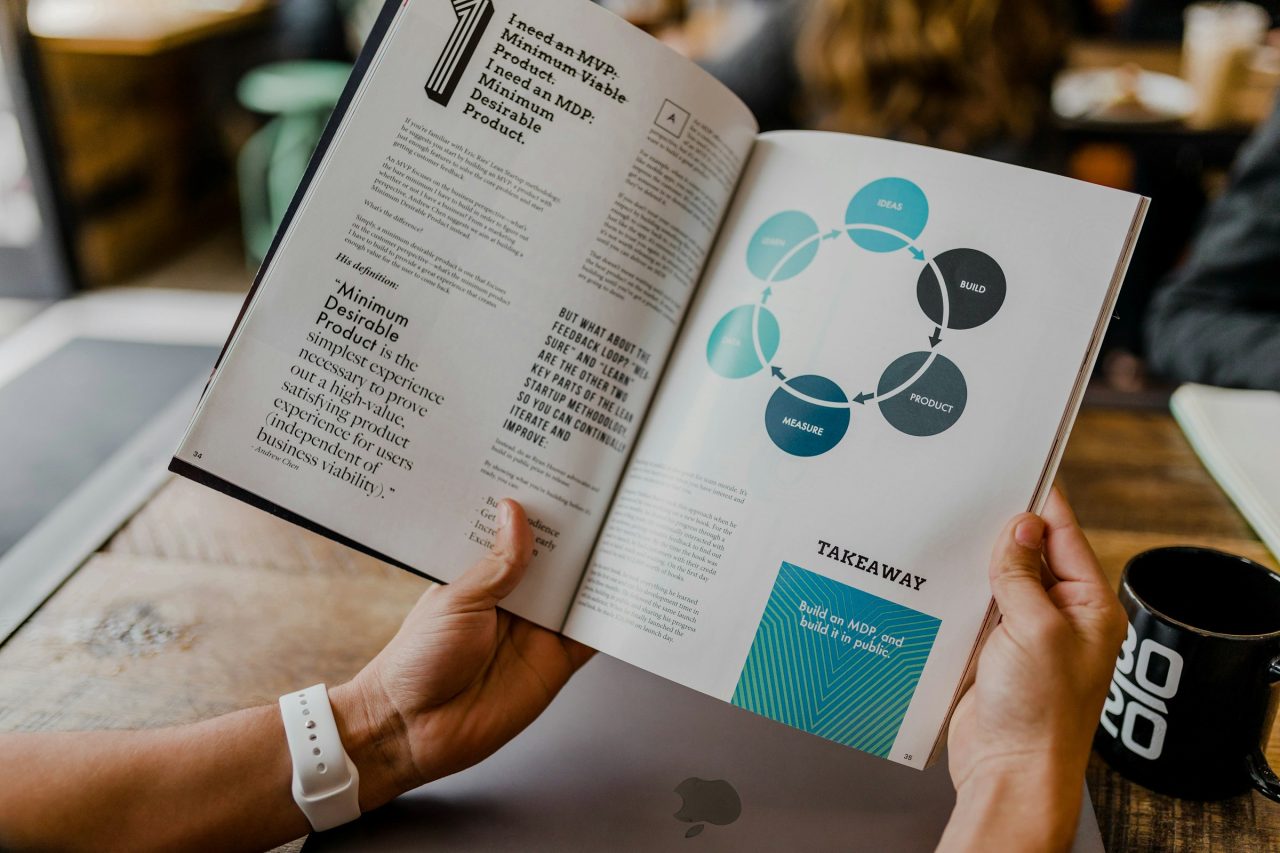

As AI becomes more accessible, industries once constrained by capital and infrastructure are now seeing rapid innovation. Application-layer innovation, long predicted to be AI’s most impactful frontier, is now proving its value — cutting costs, accelerating scale, and powering localized solutions.

Southeast Asia is already experiencing AI-driven transformation across key sectors. Startups leveraging applied AI are scaling with significantly lower capital requirements — achieving in months what once took years and millions of dollars. In Indonesia, fintech innovations — thanks to companies like OVO, Dana, wagely, GoTo Financial, Alami, etc. — have propelled financial inclusion, pushing the national index to 84%, up from 49% in 2014. In Vietnam, AI-powered agritech solutions such as Enfarm and TechCoop fragmented supply chains, address labor shortages and climate challenges in agriculture, a sector that employs 30% of the country’s workforce. AI-driven edtech platforms like Ruangguru and Edupia, along with healthtech startups like Halodoc and Doctor Anywhere, are bridging gaps in education and healthcare.

This shift is visible across emerging markets: In India, where over a million people join the workforce every month, AI-driven platforms like BetterPlace, Awign, and Naukri are improving job access and reducing hiring and workforce management inefficiencies. In Nigeria, fintech startups like Moniepoint, Africa’s 8th unicorn, serve 38 million unbanked adults, while Latin America’s agritech companies are transforming traditional farming into a data-driven industry.

Given the scale of opportunities in these regions, applied AI is not just optimizing businesses – it is redrawing economic maps.

Balancing Opportunity with Risk: The SEA Investor Perspective

Scaling AI solutions often presents challenges in reliability, security, compliance, and ethical deployment. Regulatory diversity shapes investment strategies across SEA. Singapore, for instance, has adopted a light-touch, voluntary approach to AI regulation, while Malaysia has established a national AI office focused on policy formulation and regulation, aiming to become a key regional player in AI advancement. However, in Indonesia and Vietnam, evolving AI regulations create compliance challenges, adding uncertainty for cross-border expansion.

This fragmented regulatory landscape underscores the importance of investor adaptability in navigating AI governance across SEA markets. Unlike in India, where the $1.25 billion IndiaAI Mission provides centralized policy direction, Southeast Asia’s regulatory frameworks remain market-specific. Investors and founders who understand SEA’s varying AI compliance structures will be best positioned to capture growth opportunities while mitigating policy risks.

Talent constraints are another key concern. Southeast Asia’s AI talent shortage is one of the most significant barriers to scalability, with data showing that by 2030, 72% of job market skills will need to evolve to meet AI-driven workforce demands. While India, Brazil, and Nigeria have strong software engineering pipelines, SEA’s AI expertise remains concentrated in urban hubs like Singapore, Jakarta, and Ho Chi Minh City. This creates both a challenge and an opportunity — investors who back applied AI startups that integrate workforce upskilling and automation solutions will gain long-term competitive advantages in SEA’s fast-digitizing economies.

The Changing Role of Investors

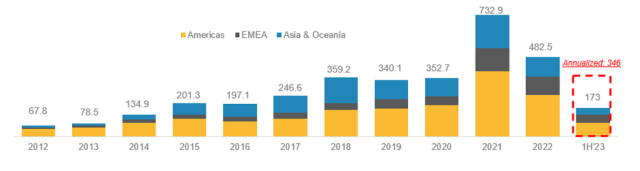

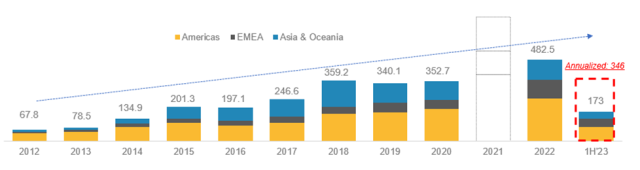

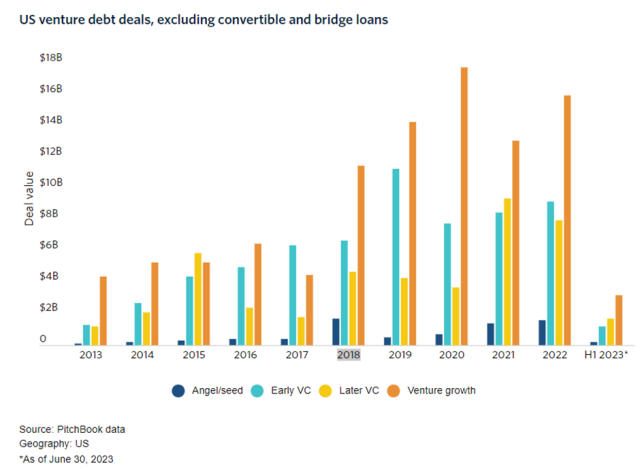

With AI infrastructure investments concentrated in China and the U.S., SEA’s applied AI sector remains underfunded and undervalued — creating a rare arbitrage opportunity.

The old Silicon Valley playbook of cash-burning expansion is being rewritten, and capital efficiency is now a competitive edge. Recent open-source breakthroughs — including DeepSeek, Qwen, Mixtral, LLaMA 2, Falcon, etc. — have collapsed AI costs, enabling startups leveraging AI to scale with unprecedented efficiency. The next wave of breakout companies will be built leaner, smarter, and faster — prioritising profitability and growth over unsustainable scaling models.

Unlike capital-intensive deep-tech plays, applied AI businesses monetize rapidly and withstand market downturns — presenting a rare window for investors to secure high-growth, high-efficiency returns. As adoption accelerates, SEA’s AI-powered startups are poised to see rapid valuation adjustments — similar to India’s post-2018 fintech boom, where Paytm, Razorpay, and PhonePe delivered outsized returns.

In this shifting landscape, investor success will depend on:

- Navigating fragmented markets with strategic entry guidance

- Understanding evolving AI governance to mitigate regulatory risks

- Building data access and ecosystem partnerships that create durable moats

- Enabling cross-border scaling to unlock regional and global opportunities

Institutional capital is beginning to recognize Southeast Asia’s AI potential, but funding remains disproportionate ($1.7B in 2024 vs. $20B across broader Asia). Early signs of M&A activity in Singapore and Malaysia’s $250M investment in semiconductor AI signal growing government backing. However, success in this new era will not come from building AI infrastructure — it will come from applying AI to solve deep, localized challenges.

The Global South Rises

As falling AI costs lower barriers to entry, investors who rethink their engagement models will define the next generation of winners. They will no longer be predominantly from Silicon Valley; a growing number will rise from Lagos, Jakarta, São Paulo, and Bangalore — redefining industries, unlocking new markets, and expanding economic mobility for billions.

This democratization of AI capabilities represents perhaps the most significant redistribution of technological power in decades. While developed markets focused heavily on foundation models and infrastructure, entrepreneurs across India, Southeast Asia, Africa, and Latin America have been quietly building AI applications tailored to local markets worth collectively trillions. These applications tackle region-specific problems that global solutions often overlook — from financial inclusion platforms capable of credit-scoring without conventional banking histories to agricultural AI systems designed for smallholder farmers and healthcare diagnostics customized for underserved populations.

The emerging pattern suggests a bifurcation in the AI investment landscape: while capital-intensive foundation model development remains concentrated in technologically advanced markets, the most promising applications layer is increasingly distributed globally. This shift mirrors earlier technology cycles where the most enduring value was ultimately captured not by infrastructure providers but by those who built compelling use cases on top of standardized platforms.

Investors who recognize this shift — and act now — will secure the most meaningful returns, both financially and in terms of impact. Those who continue applying outdated investment frameworks that prioritize technological sophistication over market fit and execution will miss perhaps the decade’s most significant wealth creation opportunity. The future AI giants may not emerge from familiar innovation hubs, but from entrepreneurs solving real-world problems in Jakarta’s traffic jams, Nigeria’s healthcare clinics, or Brazil’s agricultural heartland—entrepreneurs who understand that AI’s true promise lies not in its technological elegance, but in its human application.