House View: From Storms to Sunshine

Tough, challenging, economic headwinds, cautious optimism, interest rate hikes, downrounds, pay-to-play, layoffs – all these were words that startup entrepreneurs and venture investors became familiar with 2023. However, the year also saw several noteworthy developments that had a lasting impact on the venture capital landscape. We will address them in this quarter’s House View.

AI Ascending

2023 was a defining year for the Artificial Intelligence (AI) industry. AI became increasingly integrated into various industries, including healthcare, finance, manufacturing, and retail. Developments in machine learning, natural language processing, computer vision, and robotics were at the forefront of AI advancements. These technologies were driving innovation across sectors. Businesses leveraged AI to improve efficiency, customer experiences, and decision-making processes. Large tech companies continued to acquire AI startups to enhance their AI capabilities and expand their market presence. Microsoft became a leader in AI adoption with close integration of ChatGPT into its Bing search engine since announcing a $10 billion investment in OpenAI, the creator of the ChatGPT chatbot. What is exciting is the combination of the power of large language models (LLMs) with data in the Microsoft apps to turn words into the most powerful productivity tool on the planet. But as AI adoption grew, there was also a growing focus on ethics and regulations surrounding AI applications, particularly in areas like data privacy and algorithmic bias.

Silicon Valley Bank Collapse

One of the most notable events of 2023 was the sudden collapse of Silicon Valley Bank in March, a venerable institution that had long been synonymous with the technology and innovation hub of California. Its downfall sent shockwaves through the startup ecosystem, serving as a stark reminder of the fragility that can underlie even the most established financial institutions. In the aftermath of SVB’s failure, startups and venture capital funds faced not only the practical challenges of disrupted financial operations but also the psychological impact of shattered trust in financial institutions. This event served as a critical lesson in risk management and diversification, reinforcing the need for resilience and adaptability in the ever-evolving landscape of the startup and venture capital world. It also highlighted the importance of contingency planning and the necessity of spreading financial risks across multiple trusted partners to safeguard the interests of all stakeholders.

End of IPO Ice Age?

The IPO market remained frozen throughout 2023, save for a few iconic listings like Arm, Instacart, and Klaviyo, depriving startups of a traditional exit strategy and forcing them to reassess their growth trajectories. Courier startup J&T Global Express, which launched in Indonesia before expanding across Southeast Asia and China was valued at $13 billion in its Hong Kong IPO, below its last private round valuation of $20 billion as reported. Singapore’s first SPAC, VTAC, listed in January 2022 and backed by Vertex Venture Holdings, the venture capital arm of Singapore’s sovereign wealth fund, Temasek Holdings. VTAC merged with Asia’s live streaming app 17LIVE to take the startup public on Singapore’s stock exchange in December 2023.

What could be the catalyst that rekindles the interest in tech startup IPOs? First and foremost, a resurgence of confidence in market stability is essential. Renewed assurance that market volatility could be normalizing may set the stage for increased IPO activity. Furthermore, decisions made by the US Federal Reserve and other central banks concerning interest rates will wield considerable influence. These decisions ripple through the technology sector, impacting future cash flows of companies, driving valuation rebounds, and shaping investor sentiment. The current challenging capital market conditions present an opportune moment to lay the groundwork for an IPO, especially considering that the preparation process typically spans 12 to 18 months. Commencing preparations today positions companies to be fully prepared when favorable market conditions eventually return. On the 2024 IPO pipeline watchlist are some exciting candidates, including OpenAI which saw a leadership drama cutting its valuation down to $50B, Stripe – the Fintech payment darling that played a key role in disrupting the payments world with an estimated $50B valuation and Canva, the Adobe competitor with a potential $10B valuation.

From Setbacks to Comebacks

As we navigated the year, venture capital funds found themselves closing the books on a tough and transformative period. VC deals, exits, and fundraising all experienced a dramatic downturn, challenging the industry’s resilience and adaptability.

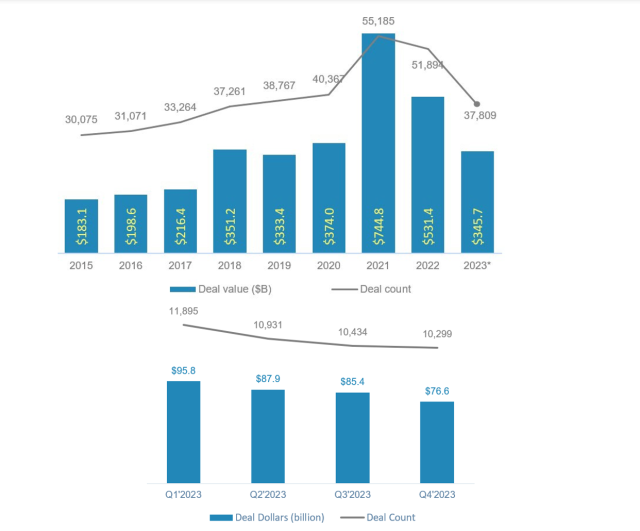

Global VC funding plummeted to approximately $345 billion, a substantial decline from the robust $531 billion recorded in 2022. This was reflected in both declining global VC deal count and dollars as illustrated below.

Southeast Asia observed a near identical trend. According to DealStreet Asia’s Singapore Venture Funding Landscape 2023 report, the region registered a 30% year-on-year decline in deal volume in 2023 (9 months) with total deal value down by 50%. While Singapore continues to be the region’s top tech investment destination (64% of total deal volume), deal value (-49%) and deal volume (-21%) both registered declines in 2023. Seen in context however, funding activity has reverted to levels last seen in 2019 which is an encouraging sign given that “the subsequent funding surge during 2021-2022 was an anomaly fuelled by a global liquidity glut”. Further, we note that “Seed to Series B” deals garnered a larger share in 2023 “indicating a growing investor preference for moving upstream”.

Facing a capital crunch and a prolonged fundraising runway that typically stalled on the topic of valuation, startups have had to trim their operations to achieve financial sustainability. Those that were able to achieve this newfound cashflow breakeven were in a unique position to capitalize on a changing business landscape. Founders started to experiment with marketing strategies that increase ROI (return on investment) – for example, optimizing marketing spend by adjusting social media campaigns to reduce burn and drive outcomes, reducing product SKUs, negotiating and extending payment terms extending working capital cycles. With healthy cash reserves in bank accounts, these lean and financially positive startups were not just weathering the challenging market conditions but actively seeking opportunities to expand their influence and market share.

Founders also recognized that a tumultuous year had created fertile ground for strategic acquisitions and talent acquisition through acqui-hiring. One notable example was turnaround fund Turn Capital acquisition of Flash Coffee’s business in Thailand. This strategic move aimed at revitalising Flash’s coffee business and aims to open over 100 new stores within the next two years. Another compelling instance unfolded in the acquisition of Loom, a video messaging startup that had once achieved unicorn status. Collaborative software giant Atlassian recognized the potential and value in Loom and acquired the San Francisco-based startup for a substantial $975 million. Notably, Loom had recently raised $130 million in a Series C funding round in May 2021, at a valuation of $1.5 billion. Atlassian’s acquisition represented a strategic move to leverage Loom’s capabilities, and despite the 35% decline in valuation from the previous round, it underlined the significance of acquiring talent and technology to drive future growth in the rapidly evolving landscape of tech startups.

In the current global startup landscape, a positive and healthy recalibration period is underway, exemplified by success stories like Lenskart’s recent achievement. Securing a substantial $500 million investment from the Abu Dhabi Investment Authority at a solid $4.5 billion valuation, Lenskart’s remarkable journey showcases the potential for startups to thrive when pursuing profitability and strategic excellence. With a network spanning 2000 stores across India, Southeast Asia, and the Middle East, Lenskart not only highlights its impressive scale but also underscores its claim to profitability—a rare feat in the startup world. This milestone serves as a valuable lesson for all emerging companies, emphasizing the need to reevaluate their strategies. Startups are now encouraged to shift their focus towards profitability, exercise prudent expense management, and prioritize establishing a strong market position. However, Lenskart was not alone in its impressive feats. Other startups also closed spectacular funding rounds in the final weeks of 2023, solidifying the industry’s positive momentum. Klook, a trailblazer in the travel technology sector, secured an impressive $210 million in Series E+ funding. Simultaneously, Silicon Box, a key player in the semiconductor arena, raised a significant $200 million in Series B funding.

Fundraising Gains Momentum

Venture funds witnessed a decline in fundraising, reflecting a stark contrast to the previous year’s numbers. VC firms managed to collect only $161 billion, a considerable drop from the impressive $307 billion raised in the preceding year. Notably, New Enterprise Associates (NEA) stood out as a fundraising leader, securing slightly over $6.2 billion for two new funds, and with NEA announcing its first Indonesia investment into Gravel, an Indonesia-based construction tech startup raising $14m Series A to extend its capacity to help anyone build, renovate, and repair living, working, and recreational spaces efficiently by using technology to connect customers to not only qualified construction workers, but also tools, building materials, and experts. Meanwhile, Bain Capital Ventures, a San Francisco-based multi-stage venture capital firm, successfully closed two funds, amassing a total of $1.9 billion in commitments.

Vertex Ventures also made headlines by finalizing Fund V with $541 million, adding to the growing momentum of venture capital in the region. Meanwhile, Singapore-based Northstar Group achieved a significant milestone by completing the fundraising for Northstar Ventures (NSV) I, its first-ever early-stage fund, garnering a remarkable $140 million in capital commitments. Korea Investment Partners entered the Southeast Asia scene with a bang, announcing its inaugural $60 million Southeast Asia Fund. United States venture capital firm In-Q-Tel, Inc. (IQT) has announced the opening of a new office in Singapore.

These developments in VC fundraising underscore the evolving landscape of venture capital, reflecting a range of strategies and niches being explored by firms worldwide as they navigate the changing dynamics of the startup and investment ecosystem.

Stepping into 2024, it’s against the backdrop of remarkable resilience and adaptability that a series of transformative developments and a shifting mindset have left an indelible mark on the world of startups and venture capital. Positive signals of tailwinds are propelling startups toward profitability while refining sustainable business models with a focus on capital efficiency. Abundant VC PE dry powder has reignited dealflow, instilling hope among venture capitalists for increased investment in both emerging and established startups, poised to redefine the technology industry.

Kickstarting 2024: AI + HealthCare

In January 2024, the tech world geared up for two major events that promise to set the stage for an exciting year of technological innovations.

The first is the renowned J.P. Morgan Healthcare Conference (JPMHC), now in its 42nd year, which stands as the industry’s largest and most informative healthcare investment symposium. Held annually in San Francisco, it serves as a pivotal platform for showcasing groundbreaking healthcare technologies and trends.

In San Francisco, the JPMHC spotlighted 2023 as a robust year for mergers and acquisitions (M&A), driven by a flurry of nine M&A deals valued at over US$1 billion each that were announced towards the end of the year. The pharmaceutical giants, often referred to as Big Pharma, have been actively seeking strategic acquisitions to replenish their pipelines in response to drugs nearing patent expiration. These high-value M&A transactions primarily focused on target companies boasting late-stage assets, including marketed drugs and products with clinical proof of concept in phase 3 trials.

Meanwhile, venture capitalists (VCs) in the healthcare and life sciences sector remain well-positioned with significant capital reserves ready for deployment. Notably, new funds like Goldman Sachs’ impressive US$650 million fund, West Street Life Sciences I, have emerged with a specific focus on early- to mid-stage therapeutic companies. These companies are characterized by multi-asset portfolios and encompass tools and diagnostics firms within their investment scope, signaling a dynamic and active investment landscape within the healthcare and life sciences sectors.

The data indeed reflects a notable trend: Seed stage and modest Series A financings continue to thrive in the investment landscape. However, when it comes to larger Series A and subsequent funding rounds, a clear division persists between the ‘haves’ and the ‘have nots.’ For the fortunate few, particularly those operating in hot therapeutic areas or are armed with recent data readouts that significantly de-risk their programs, capital remains readily accessible.

A striking example of this phenomenon is demonstrated by Aiolos Bio, which secured an impressive US$250 million in a Series A round for its Phase II-ready asthma/anti-inflammatory antibody targeting the TSLP pathway—technology in-licensed from Hengrui. Aiolos Bio later astounded the market by announcing its acquisition by GSK for a staggering US$1 billion upfront, with the potential for an additional US$400 million in milestones, underscoring the value of strong data and de-risked programs.

Meanwhile, Indonesia’s leading health-tech platform, Halodoc, which offers a range of healthcare services through telemedicine, medicine delivery, lab tests, and doctor appointments via smartphones, secured a substantial $100 million in Series D funding, highlighting the continued interest in health-tech innovations.

Consumer Electronics Show (CES), originating in 1967 with 250 exhibitors and 17,500 attendees in New York City, has since evolved into a global tech extravaganza. CES not only presents the latest technological advancements but also offers a glimpse into the future of the tech world. Notably, both events share a common theme: the pervasive presence of artificial intelligence (AI). AI’s influence is palpable, whether it’s in drug development, robotics, or consumer products, reaffirming its pivotal role in shaping the future of technology.

Among the groundbreaking innovations showcased at the event, Betavolt, a startup hailing from China, introduced a truly revolutionary nuclear battery technology that promises to generate electricity continuously for an astounding 50 years without the need for recharging or maintenance.

What sets Betavolt’s creation apart is its groundbreaking integration of 63 different isotopes into a module that’s smaller than a standard coin, marking a significant leap in the field of atomic energy. This achievement challenges conventional wisdom associated with nuclear technology by achieving the remarkable feat of miniaturizing atomic energy. The battery’s compact dimensions measure just 15 x 15 x 5 millimeters, constructed from delicate layers of nuclear isotopes and diamond semiconductors. It is envisioned as a remarkable technological marvel that holds the promise of keeping electronic devices charged and fully operational for an astonishing half-century. This breakthrough ushers in a transformative era of sustainability and unprecedented longevity in the realm of portable power solutions.

ChatGPT will be shoe-horned into everything. Teamwork between Volkswagen and Cerence to harness its Chat Pro “automotive grade” artificial intelligence platform, which enables the ChatGPT integration. This expands the German marque’s existing IDA voice assistant so it can now deal with natural speech prompts for both control of the vehicle’s functionality and broader queries.

Motion Pillow revealed a self-inflating, AI-powered smart pillow designed to curb snoring. Once the system identifies snoring, the pillow gently inflates to subtly adjust the sleeper’s head position. Through the movement of 7 airbags, it dynamically adjusts the positions of the head and back, creating a comfortable breathing environment and reducing snoring. The product has been further enhanced with an increased number of airbags, the vital ring for oxygen saturation measurement, circadian rhythm lighting, and a space-saving charging system, all contributing to improved performance, usability, and adding a touch of sophistication. This side-lying posture is known to be less conducive to snoring, as it helps keep airways open. The inflation mechanism is designed to be both quiet and gradual, ensuring minimal disturbance to the sleeper.

ElliQ, the innovative care companion robot introduced by Intuition Robotics, plays a vital role in addressing the growing sense of isolation experienced by older adults in our increasingly technology-driven world. This is particularly crucial in an era when staying digitally connected is paramount due to the limitations on physical interactions. With approximately 50% of adults grappling with concerns related to social alienation and declining health, ElliQ emerges as a solution designed to bridge this gap.

ElliQ serves as an interactive tabletop health companion, thoughtfully crafted to assist older adults in maintaining their mental and social well-being. By engaging in various activities and providing companionship, ElliQ not only alleviates feelings of isolation but also encourages essential mental and social interactions. It represents a compassionate response to the challenges faced by older individuals in our technology-centric society, reaffirming the potential for technology to enhance the quality of life for all generations.