Unlocking the World of Private Debt: Venture Debt vs. Growth Debt

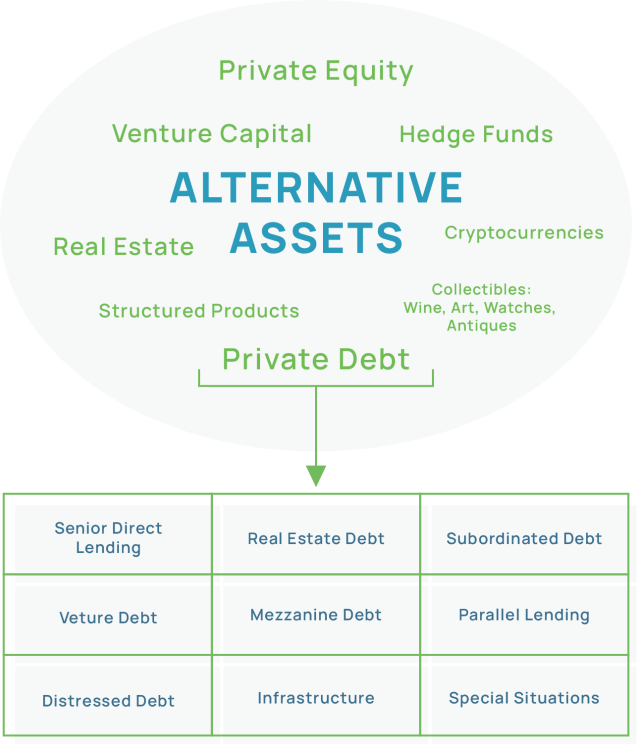

Private Debt has been grabbing headlines, with terms like Private Credit, Venture Debt, and Growth Debt often used interchangeably. However, it’s crucial to grasp the distinctions and understand the nuances. In this article, we unravel the intricacies of the overarching term “Private Debt” and focus on two key verticals – Venture Debt and Growth Debt – which are valuable financing tools for startups and scale-ups respectively.

Private Debt Landscape: Beyond Conventional Banking

Private Debt, a form of Alternative Assets, encompasses debt financing provided by private markets to companies outside traditional bank lending. Players in this arena include Debt Funds, Hedge Funds, Family Offices, Sovereign Wealth Funds, Non-Bank Financial Institutions, and Crowdfunding Platforms.

Venture Debt: Empowering Tech Innovators

Venture Debt is tailored for early-stage tech or tech-enabled companies (Series A and beyond). These companies, usually less than three years old, show high revenue growth, and have a unique/disruptive business model but are still burning cash. Venture debt has been a common financing tool in Silicon Valley but is still relatively new in Asia. Since Genesis first launched our venture debt fund five years ago, VC-backed companies in Southeast Asia have become more sophisticated about using venture debt as part of their overall capital financing strategy,

Venture Debt Structures: The Nuts and Bolts

Venture Debt typically takes the form of a term loan with a tenor of up to 36 months, repaid through monthly Principal and Interest amortization. Borrowers can access 20-30% of their recent financing round or cash on the balance sheet.

Reasons to opt for Venture Debt:

- Filling working capital gaps for tangible outcomes, such as buying goods or raw materials.

- Extending cash runways to reach crucial milestones, potentially enhancing future equity valuations.

- Diversifying funding sources and reducing the weighted average cost of capital.

- Minimizing dilution of early investors and founders across successive fundraises.

When to avoid Venture Debt:

- Filling in for shortfalls or failures in equity fundraising.

- The remaining cash runway is short and no other funding is available.

- Funding Research and Development without a clear path to a commercial outcome.

Growth Debt: Fueling Expansion for Tech Titans

Growth Debt goes beyond Venture Debt by offering larger cheque sizes to mid to late-stage tech companies with revenues ranging from $10 million to over $100 million. Unlike Venture Debt, Growth Debt is not solely dependent on equity fundraising events and may serve as a substitute for equity. Examples of Growth Debt are Genesis’ loan to a leading global spatial data company before their IPO, as well as to Indonesian fintech firm, Akulaku. In essence, growth debt is a financing tool customized for later-stage startups who are hyper-scaling and preparing for an exit event.

Reasons to opt for Growth Debt:

- Consolidating debt across entities or jurisdictions.

- Refinancing costly or small quantum debt to benefit from improved terms e.g. lower interest rates or upsized debt.

- Financing final rounds leading to profitability or pre-IPO stages.

- Substituting for equity, reducing dilution for founders and early shareholders.

- Funding projects with robust cash flows supporting debt repayment solely based on internal cash generation.

- Acquiring an M&A target.

Credit Underwriting for Growth Debt: A Quick Overview

The credit underwriting process for Growth Debt is intricate, focusing on the company’s existing leverage, ability to achieve growth targets, reach profitability, and navigate market dynamics. Lenders assess the company’s attractiveness as a buyout or refinancing target, considering potential challenges to the original business case.

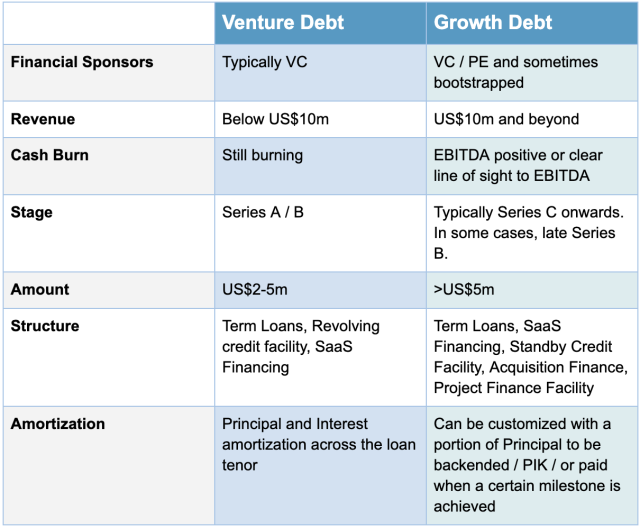

Comparing Venture Debt and Growth Debt: Key Distinctions

Venture Debt complements equity, emphasizing the fundamental quality of the borrower and its Financial Sponsors. Growth Debt at times may act as a substitute for equity, focusing on the company’s ability to execute growth plans independently and repay debt from internal cash generation.

The Genesis’ Approach: More Than Just Capital

Whether providing Venture Debt or Growth Debt solutions, Genesis takes a value-add approach, partnering with borrowers beyond cash. For insights on integrating debt into your fundraising plan or capital structure, we invite you to engage with us and explore the possibilities.

The table below outlines the differences and similarities between Venture and Growth debt.

For more information about Venture Debt and Growth Debt, please email us at contact@genesisventure.co.