Jeremy Lee: Cleaning Up the Planet, One Tablet at a Time

Welcome back to the Genesis Founder’s Playbook series is a collection of curated insights and experiences from exceptional startup founders. Within this treasure trove, entrepreneurs share their valuable knowledge and hard-earned lessons with the startup community.

In this series, we’ve showcased founders who have navigated the challenges of being solo entrepreneurs, tackled taboo pain points, and driven impact and profits. Threaded through these conversations is apassion for solving real-world problems, with a blend of tenacity and agility.

In our first Founder series for 2024, we spoke to Jeremy Lee who brings to mind the movie “Moneyball,” which based on the true story of the Oakland Athletics baseball team. In this movie, Billy Beane (portrayed by Brad Pitt) served as the general manager who built a winning team with limited resources. How? By challenging a player selection system that had proven effective for over a century but gives richer teams the upper hand.

SimplyGood, Jeremy’s latest venture, was born from his observation of the inefficiencies within the cleaning and personal care products sector, a domain largely monopolized by major FMCG players with established brands. Notably, these products, constituting a whopping 96% water, pose logistical challenges due to their bulkiness and weight during transportation. Moreover, they contribute to environmental pollution with their heavy reliance on single-use plastics.

Jeremy’s innovative solution offers consumers the essential cleaning ingredients in a dehydrated tablet form, creating a product line that is 200 times lighter and 300 times smaller than a conventional 500ml bottle of cleaning solution. This saves packaging, transportation, and logistics while reducing carbon footprint. Cost efficiencies are passed on to the end users, allowing them to clean without guilt.

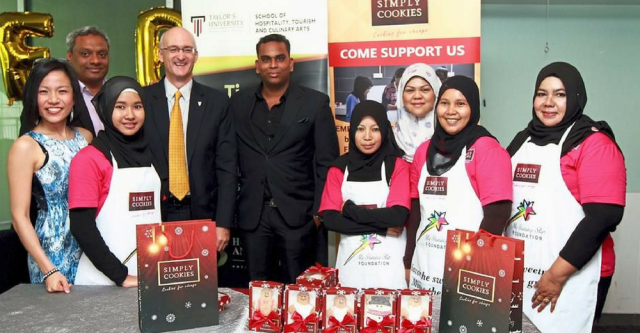

Photo credit: SimplyGood

SimplyGood was born from his first venture, UglyGood, which he ran with a co-Founder during his university days. Driven by a commitment to sustainability and the circular economy, UglyGood ingeniously upcycled fruit pulp from local food manufacturers into valuable products such as animal feed, enzymes, and essential oils. Indeed one person’s waste is another’s treasure.

Now as a solo Founder who navigated SimplyGood through the challenging tech funding winter, he shares the following insights from his playbook:

++++

Jeremy’s journey in his own words:

Product-Market Fit is always a work in progress: When we launched SimplyGood, it was on the promise of eco-friendliness and sustainability. However, what we quickly realized was that while we had a small but very loyal following, it did not have broad-based appeal, making it difficult for us to scale. When we pivoted our messaging to convenience and value for money, we got a much better response. To date, more than 10,000 consumers have made the switch to SimplyGood. I don’t think our product-market fit is perfect yet and I believe it will always be evolving, rather than a one-time fix.

Listening to customers: We are very thankful to have customers who are very passionate about both sustainability and SimplyGood. Over the past few years, they have given us valuable feedback to improve our product design and customer journey, which we have incorporated.

Expansion through Strategic Partnerships: As a B2C business, I’m very mindful of the cost of customer acquisition (CAC). In the first year, spending a lot of marketing and brand building was inevitable as we were unknown. However, now that we have some brand awareness, we’ve expanded to B2B corporate partnerships, such as with property developers to provide starter kits for new home purchases, as well as business users like hotels, cleaning companies, and F&B businesses.

Balancing Sales and Brand Building: The conventional thinking is to build sales before brand building. However, I’ve discovered that tackling both simultaneously can open up new sales channels. Positioning SimplyGood as a sustainable and eco-friendly option has opened doors to collaboration with like-minded retailers. We are delighted to be chosen by MUJI Singapore to be part of their Sustainable Local Brands Project, and our range of products can now be found at their Plaza Singapura and Changi Jewel stores (at no listing fee!). Our products are also on the shelves at Commune Life stores, and we continue exploring partnerships with other retailers.

Support System: Having ventured into startup life first with a co-founder and now as a solo founder, I acknowledge the importance of a co-founder for emotional and mental support, even if it means a slower decision-making process. Therefore, I make it a point to connect with other founders to have a sympathetic listening ear and share experiences. I also take mini-breaks to rest and recharge.

People Matters: As a founder, I understand the multiple demands on our bandwidth. However, I think it is important to think about team and people management, especially if you want to scale. My experience has been to hire slow, but fire fast. As we are small and lean teams, wrong hires can adversely affect momentum, performance, and culture.

Tech Winter Survival Tips: In today’s uncertain fund-raising environment, founders should continue to focus on profitability, cash flow, and sound unit economics. Shifting our mentality from raising money to building sustainable businesses will serve us better in the long run.

+++

In the cleantech arena, Jeremy Lee stands out as a visionary force transforming sustainable living. He envisions a future where supermarket shelves are stocked cleaning tablets instead of the usual plastic bottles, aligning sound business sense with eco-friendliness and responsible consumption.

Feel free to reach out if you’re keen on contributing your own war stories to enrich the Founder’s Playbook and further strengthen our founder community. Together, we can build a network that thrives and succeeds.