Public Listing via SPACs

What is a SPAC?

A Special Purpose Acquisition Company (SPAC) makes no products and does not sell anything. In fact, the SPAC’s only assets are typically the money raised in its own IPO. Generally, a SPAC is formed by an experienced management team or a sponsor with nominal invested capital, typically translating into a ~20% interest in the SPAC (commonly known as founder shares). The remaining ~80% interest of the SPAC’s shares is held by public shareholders through “units” offered in an IPO.

Some well-known names in the SPAC industry include buyout specialist Alec Gores, venture capitalist Chamath Palihapitiya, and former Citigroup Inc. banker Michael Klein, while in Malaysia, internet entrepreneur Patrick Grove also filed for a $250 million SPAC.

A shareholder that prefers to exit prior to the initial business combination can sell its units in the market or choose to have its shares redeemed for its pro rata portion of cash from the IPO that is being held in the trust. At this stage, the SPAC typically does not have a target company to merge with.

In its IPO, a SPAC typically offers units, consisting of a share of common stock and a fraction of a warrant, at $10 per share.

The money raised then goes into an interest-bearing trust account until the SPAC’s founders or management team identifies a private company looking to go public through an acquisition.

From a SPAC to De-SPAC

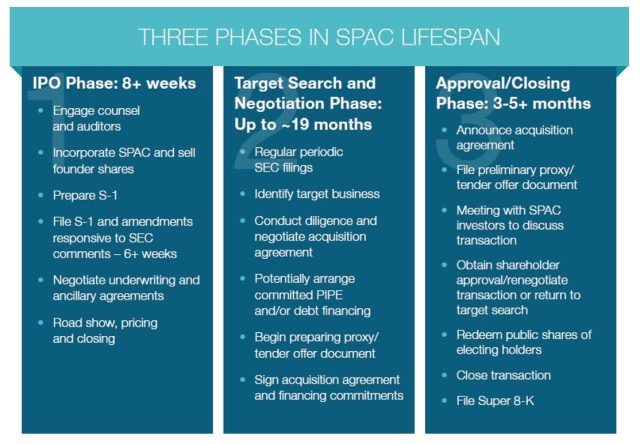

The SPAC is required by its charter to complete that initial business combination — or “de-SPAC” transaction — typically within 24 months, or liquidate and return the gross proceeds raised in the IPO to the public shareholders.

Once an appropriate target company has been identified, the SPAC and the target undertake a merger, acquisition, or other transaction that results, in most cases, in the operating business becoming a publicly traded company that effectively “takes over” the public company status of the SPAC. As a result of this process, the SPAC is “De-SPAC” and continues its life as a public company.

The De-SPAC process is similar to a public company merger, except that the buyer (the SPAC) is typically required to obtain shareholder approval, which must be obtained in accordance with SEC proxy rules, while the target business (usually a private company) does not require an SEC-compliant proxy process.

Complementary PIPE Financings

A SPAC can seek a PIPE (private investment in public equity) deal if it needs to raise additional capital to close a merger transaction with a target company. A PIPE arrangement may become necessary where the cost of acquiring a target company exceeds the funds that a SPAC has in its trust account. For example, Singapore’s sovereign wealth investor GIC announced a $200 million PIPE into SPAC-backed View Inc. Tiger Global, along with others, will inject $295 million via a PIPE into the Matterport-Gores SPAC.

Besides providing capital, PIPE investors can also validate the valuation of the target company. Raising a PIPE is quite similar to a normal fundraising round where the PIPE investors will value the target. PIPEs prove that there is investor demand for the company at a certain price. Once the PIPE is closed and the SPAC merger announced, and if the PIPE is oversubscribed, investors who could not gain access during the PIPE would be able to purchase in the public markets instead. There are short-term arbitrage SPACs with investors who have no interest in actually owning the company being taken public.

SPACs in Asia

Asia’s representation in the global pie has been small so far – about 11 out of 2021’s 304 SPAC IPOs, and just US$4.7 billion in SPAC mergers. Given the region’s large pool of new-economy companies, bankers are now plugging it as a hot spot for merger targets.

It was reported that SoftBank-backed Grab will go public through a merger with a SPAC that could value the ride-hailing giant at nearly US$40 billion (S$53.6 billion). This would make the Grab SPAC the largest-ever, blank-cheque deal.

Singapore’s SGX is the first major Asian bourse to consider the listing of SPACs. The Exchange is proposing regulations to allow SPACs with a minimum market value of S$300 million (US$223 million). Hong Kong, Indonesia, and other markets are stepping up efforts for SPAC listings.