In this issue of our House View, we shine the spotlight on an extremely talented individual within the Genesis ecosystem, Tom Kim, founder and CEO of Deliveree.

Deliveree was established in 2015 with a core focus on the efficient transportation of commercial goods and large items across Indonesia, the Philippines, and Thailand. The company set out to address the challenges associated with transportation inefficiencies and the high cost of logistics. The company is projected to exceed $100 million in GTV this year. Deliveree has a team of 550 dedicated employees and a robust network of 100,000 drivers operating on its platform. Deliveree has successfully raised $109 million in capital to date.

The problem Deliveree is solving is the prevalence of one-way deliveries leading to empty return trips. In short, Deliveree devised a dynamic marketplace that connects independent drivers and trucking companies on the supply side, with tens of thousands of customers driving the demand. Matching supply to demand in this manner is no easy task, yet Deliveree managed to overcome this challenge and achieve a utilisation rate of nearly 70%, which surpasses the industry average that sits at under 50%. This accomplishment has direct positive effects on both the environment and productivity, as fuel and time are optimized. Moreover, it benefits independent truckers who rely on commission-based earnings, thereby allowing them to earn more. Notably, customers such as UPS, DHL, Philip Morris, Suntory, and Lotus’s (formerly Tesco) can now leverage an asset-light approach, booking trucks as and when necessary, which helps streamline their balance sheets.

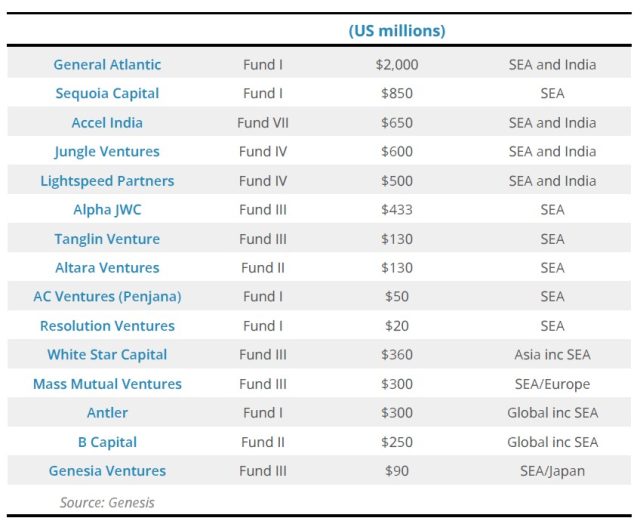

The Genesis team first engaged with Deliveree in 2016 for discussions around debt financing and then again in April 2020. Deliveree stood out to Genesis for several reasons, including healthy, mid-teen gross margins, a dedicated and experienced management team, with a strong commitment to resolving logistical challenges. Genesis and Deliveree shook hands on a first debt facility soon after and Genesis subsequently participated in an additional round that saw Deliveree complete a massive $70 million Series C funding in June 2022.

Genesis’ investment philosophy includes a dedication to supporting startups with meaningful impact objectives. We work closely with our portfolio companies, assisting them in identifying and implementing essential impact and environmental, social, and governance (ESG) concepts throughout Southeast Asia. Deliveree is amongst the first of our portfolio companies to demonstrate a bold commitment to these principles. In May 2023, Deliveree published its inaugural report detailing its ESG and impact achievements. We are proud to have played a small part in Deliveree’s journey in this regard.

Please enjoy this Q&A with Tom.

Tell us more about your declaration of war against empty trucks and how far has Deliveree’s technology and marketplace come?

Tom Kim [TK]: Deliveree connects thousands of truck drivers and cargo shippers through its dynamic marketplace where they can find and fulfil orders every day. We are constantly upgrading our tech stack which is now third generation and going onto its fourth evolution. These improvements are based on the feedback of our loyal business customers.

Our drivers use our proprietary mobile app that shows them the live bid price and lets them accept delivery orders on the go, even while they are on a specific route. The app also helps Deliveree to track the trucks’ location and offer a hyper-local view of truck capacity for route planning.

Using our Big Data and predictive analytics, we “smart assign” bookings to drivers, which enables them to create optimised routes and schedules. On average, our drivers achieve utilisation rates ranging from 60% to 80%, with an average of 70%, as they criss-cross the map every day picking up and dropping off loads for a diverse range of customers.

In turn, this allows customers of all sizes to access affordable, flexible, and scalable trucking and cargo shipping solutions in a way that significantly increases efficiency and reduces cost. We can achieve these utilisation rates within metropolitan areas and even across larger areas such as Java Island in Indonesia, Luzon Island in the Philippines, and the Bangkok Metropolitan Area in Thailand.

Please elaborate on Deliveree’s “smart assignments” technology and how that sets you apart from traditional logistics providers?

TK: Deliveree’s “smart assignments” technology sets it apart from traditional logistics providers. This technology, driven by intelligent algorithms applying massive historical data sets, assigns trucks to bookings in the most optimal locations and times. This maximises truck utilisation and minimises empty driving distances, resulting in higher efficiency.

We believe that Big Data is the key to logistics evolution in Southeast Asia. Our success hinges on the ability to gather, combine, and effectively use data sets to tackle the region’s logistics efficiency challenges. In contrast, many competitors are still in the early stages of their first or second-generation tech, lagging behind Deliveree in user experience, features, integration capabilities, toolsets, and most importantly, Big Data and predictive analytics.

A key feature of smart assignments is the ability to estimate the duration of each booking based on massive historical data sets from seven years of operations. This allows the algorithm to help drivers build booking schedules with routes and timing that fit and flow together from one booking to the next, further streamlining logistics operations. By leveraging the power of Big Data, Deliveree aims to precisely predict booking durations, resulting in fully optimised truck schedules. This innovative approach not only solves the problem of empty trucks on the road but also addresses the elusive issue of empty backhauls (the holy grail of logistics). Moreover, it helps to reduce traffic congestion, minimise environmental emissions, increase driver earnings, and lower customer shipping costs. While it may seem too good to be true, Deliveree is working towards this future every day through significant investments in Big Data sets.

What was your motivation for setting up a formal ESG reporting process?

TK: Deliveree’s solution benefits various stakeholders, including truck drivers, businesses with goods to deliver, and even the environment. Our latest ESG report is available here.

We address the challenges faced by independent owner-operator drivers and small family trucking companies with unstable income and limited job opportunities. Through onboarding and continuous training, drivers qualify for jobs with larger enterprises that have strict requirements, such as certifications for occupational health and safety (OSHA) to enter warehouses and logistics facilities. Additional certifications, like defensive driving for energy clients and perishable goods handling for FMCG clients, are also provided.

Our comprehensive training and certification program prepares drivers for the new gig economy. Together with our mobile app, they secure delivery jobs that significantly boost their earnings, often up to 2.3 times more. This empowers businesses to connect with reliable and qualified drivers for their transportation needs while contributing to better route optimisation and environmental sustainability.

In our ESG sustainability report, you will see how our smart algorithms optimise delivery routes, providing bookings to trucks in the right place at the right time.

This increases their utilisation and decreases the distances those trucks drive while empty. Additionally, businesses can leverage Deliveree’s partial loading services, enabling them to send goods, cargo, and packages without needing to rent a full vehicle. Our algorithm calculates the most optimal and efficient route by combining cargo from multiple businesses, ensuring efficient deliveries.

Who helped you with the process and the thinking behind your ESG initiative?

TK: As part of Genesis’ venture debt to Deliveree back in January 2021, we made a commitment to Genesis Impact and E&S framework where we will start to develop a basic idea around impact development goals and objectives. However, at that time we were focusing on growth and not ready to devote resources to a deep dive to evaluate our potential ESG impact.

This changed in 2023 when our database and data science resources became substantially more sophisticated. Deliveree’s servers process vast amounts of data related to our millions of transactions and core operational functions. So the data was already there, but the hard part was building the right queries to extract, clean, and draw conclusions from the data to tell the ESG story along the main themes we outlined.

With guidance and support from Genesis who made introductions to experts and consultants in this field, we identified four key ESG impact themes that align with UN Sustainability Development Goals. Then we pursued the data extraction and analysis to validate our achievements along these themes.

We started by delving into the essence of Deliveree’s core business. While the impact was already evident, the challenge was quantifying and measuring this impact in a tangible manner. Genesis and Deliveree held several discussions, engaging in informative and collaborative discussions on quantifying impact using our existing data.

By documenting our ESG and impact achievements, we aim to strengthen our credibility in the eyes of investors, partners, clients, and vendors. This commitment to ESG impact reflects Deliveree’s dedication to sustainability and responsible business practices.

What are some key highlights of Deliveree’s ESG sustainability report for 2022/2023?

TK: At a high level, I am very proud to share the following achievements:

- Emissions Reduction: Deliveree’s “smart assignments” has reduced CO2 emissions by over 3 million kilograms, equivalent to planting 143,000 trees (UNSDG: Climate Action).

- Road Traffic Reduction: Through efficient truck assignments, Deliveree has decreased truck road usage by 5.3 million kilometres, equivalent to 7 return trips between Earth and the Moon. (UNSDG: Infrastructure and Sustainable Cities).

- Income Acceleration: Independent drivers and small trucking businesses on Deliveree’s platform experienced significant earnings growth, with average hourly earnings increasing by 2.8 times for 73% of vendors and total earnings increasing by 2.3 times for 82% of vendors. (UNSDG: No Poverty and Decent Work).

- New Economy Education: We provided extensive education to drivers, offering an average of 44 instructional hours per vendor, enabling them to thrive in the mobile app and gig economy. (UNSDG: Decent Work and Reduced Inequalities).

We have gained a strong reputation for our customer-oriented services. However, we also want to recognise the unsung heroes behind our success: the countless truck drivers who own and operate their own vehicles, as well as the small family businesses that own and manage their own fleets. Our platform empowers them to control their financial futures, leading to a positive impact on their respective communities.

What was the response to your report?

TK: Unfortunately, the response from the media and investment community was not as warm as we had hoped. From this, we realised that ESG and impact investing are still relatively young fields, and there is a limited track record of long-term performance data. In this respect, I am proud that Deliveree is ahead of the pack when it comes to monitoring our ESG and impact.

What are your business plans for the next few years?

TK: We are commencing our last private fundraising in the second half of 2023 with plans to IPO in Indonesia in late 2025/early 2026. To coincide with these capital markets plans, our consolidated group will reach EPS break-even by 4Q 2025.

Follow Deliveree on LinkedIn for more updates.