The first quarter of 2023 was not pretty for the tech ecosystem globally – a continued venture capital reset, repeated rounds of tech layoffs, the failure of Silicon Valley Bank (SVB) and Signature Bank followed by the distressed sale of Credit Suisse, a near -60% decline in startup funding across all stages.

The dreaded “C(ontagion)” word raised its ugly head in early March when the bank run on SVB came to light. With $175.4 billion in assets, serving an estimated 20,000 startups and 1,000 venture capital firms, and impacting the livelihoods of countless individuals, the stakes were high when the fate of SVB hung in the balance. The potential collapse of SVB, a historic and trusted financial institution for the startup ecosystem, caused widespread confusion and anxiety. As the go-to bank for founders and venture capital backers in Silicon Valley, SVB had long been regarded as the cornerstone of the financing universe for the tech industry. The unfolding events posed a grave danger that could potentially cripple the tech world, making timely resolution crucial for all those involved.

So, just how important is SVB to Silicon Valley? At the end of 2022, SVB was the 16th largest bank in the United States and the largest by deposits in Silicon Valley, solidifying its position as the go-to bank for venture-backed tech startups. Legendary venture capitalist, Michael Moritz, a longtime partner at Sequoia Capital calls SVB “the most important business partner” in Silicon Valley over the past 40 years. According to Steve Papa, the founder and CEO of Parallel Wireless, a startup specialising in cellular communications systems, SVB’s collapse has left a significant void in the innovation economy that may take a decade for someone else to fill. As a serial entrepreneur with successive exits such as Endeca, an enterprise software company that was acquired by Oracle for $1 billion in 2011, and Toast, a restaurant-industry point-of-sale system developer that went public in 2021, Papa attests to the pivotal role SVB played in his startups’ success. SVB’s extensive network of venture investors, financing options, payment accounts for overseas customers, and other services were a driving force behind his ventures, underscoring the significant impact of SVB’s downfall on the startup ecosystem.

Lending Into the Tech Ecosystem Key to SVB’s Dominance as a Tech Bank

With over 40 years of experience, SVB has established itself as a key player in the Silicon Valley financing landscape through its venture debt offerings. Its comprehensive product suite, tailored to the unique needs of the tech industry, includes mortgages for executives, credit lines for VC funds to maintain capital flow, and venture debt for startups that may be considered uncreditworthy by larger lenders. Moreover, SVB’s global offices enable it to serve VCs and startups worldwide, extending its reach beyond the US where it has been a trusted banking partner for over half of all tech and life sciences startups.

As of December 31, 2022, SVB’s loan book was valued at $74 billion, encompassing a diverse portfolio of loans. Approximately 56% of its loan portfolio was dedicated to venture capital and private equity firms, secured by limited partner commitments and used for investments in private companies. Mortgages for high-net-worth individuals accounted for 14% of its loans, while 24% were allocated to technology and healthcare companies, including 9% for early and growth-stage startups. Notably, Bloomberg reports that SVB’s loan portfolio comprises primarily lower-risk and lower-yield loans and strong credit performance overall.

Genesis’ Jeremy Loh, who previously worked alongside SVB in a venture equity investor role during his time in the US, witnessed firsthand how SVB served as a supportive banker and venture lender to startups in their early stages. This approach created a sense of loyalty between founders and their capital backers. In fact, SVB’s wealth management arm, “SVB Private,” identifies potential private clients early on, providing liquidity for founders whose net worth is tied to their company’s valuation, particularly those who have exited their businesses and are flush with cash.

Credit Crisis or Opportunity post-SVB?

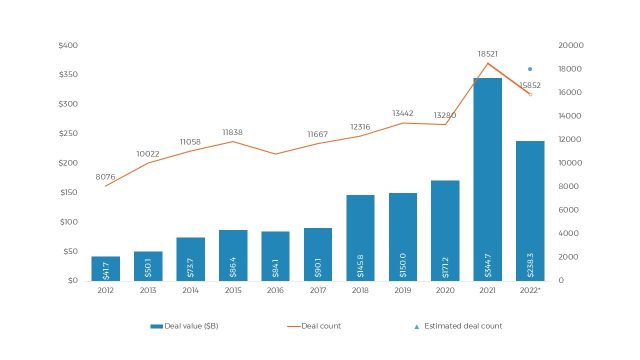

The surge in venture lending in recent years has been driven by startups’ increasing need to diversify their funding sources and reduce reliance on equity raises. PitchBook’s data shows that in the second quarter of 2022, the venture debt market saw the second-largest total value of loans in the past decade. Despite rising interest rates, over $30 billion in loans were provided to US-based VC-backed companies in 2022 (Figure 1), indicating a continued appetite for debt. SVB, being one of the largest venture lenders, exiting the market will create a gap for technology companies seeking to raise debt. It remains uncertain if other venture lenders will step forward to fill this void, especially for companies with undrawn SVB lines.

Figure 1: US venture debt activity – fourth consecutive year venture debt surpasses $30 billion in value. (Source: PitchBook)

So, who is stepping up to fill this gap left by SVB? In the US, First Citizens BancShares (Nasdaq: FCNCA) based in Raleigh has agreed to acquire SVB. This acquisition will position First Citizens as one of the top 15 banks in the US, and the 17 SVB branches will operate as “Silicon Valley Bank, a division of First Citizens Bank.” In Europe, HSBC has acquired SVB UK, which reported a profit before tax of £88 million for the financial year ending December 31, 2022. With this acquisition, HSBC aims to strengthen its commercial banking franchise and enhance its ability to serve innovative and fast-growing firms, including those in the technology and life science sectors, in the UK and internationally. This acquisition is part of HSBC’s ambition to become the tech bank of choice, as evidenced by its announcement in June 2019 to set up an $880 million technology fund to identify promising companies in southern China’s Greater Bay Area.

Reports indicate that former SVB employees have joined JPMorgan Chase, the largest bank in the US, in recent years, attempting to transplant their Silicon Valley network and investment expertise. During the SVB crisis, JPMorgan was seen as the biggest and safest bank in America by tech investors and entrepreneurs, and it is estimated that up to 90% of those who previously banked with SVB have since moved part or all of their accounts to JPMorgan, according to informal tallies shared by US VCs.

Additionally, there are existing US private credit players such as Hercules and TriplePoint, well-known names in growth and venture debt financing, that can potentially benefit from the SVB void to increase their market dominance. Hercules, with a track record of 18 years in venture and growth stage lending, has committed over $16 billion in capital to venture and institutionally-backed growth companies. Similarly, TriplePoint, an experienced venture lender, has overseen more than $9 billion in leases and loans to over 3,000 leading venture capital-backed companies.

With the increasing demand for venture debt, the venture debt market has become more lender-friendly. Overall, rates have risen and spreads have widened, allowing lenders to negotiate better covenants, and warrants have returned to debt term sheets as well. In the past, some lenders held back from warrants when company valuations were inflated and investors competed fiercely for deals, but the circumstances have changed. Lenders now see opportunities in recapitalization rounds, where having new equity is advantageous, and penny warrants do matter due to the longer timespan.

However, the repercussions of SVB’s decline could result in higher capital costs and tighter cash flows for startups, particularly those based in the US that have relied on SVB’s credit lifeline. As the largest and one of the most experienced venture debt lenders offering attractive rates to startups, it remains to be seen if the likes of First Citizen Bank and HSBC, or even JP Morgan can rise to the occasion.

In fact, recent insights from the Venture Debt Conference (March 2023, New York) via Pitchbook (reproduced below) confirm that while there have been no fundamental shifts where venture debt is concerned, the continued liquidity crunch coupled with the increased demand for venture debt will impact positively lending terms amidst a more realistic fundraising environment.

Pitchbook Analyst Note from the Venture Debt Conference (10 April 2023)

- The use of venture debt has gained in popularity as many startups look to remain private longer and seek creative forms of financing that minimize dilution.

- The collapse of SVB highlighted the importance of liquidity and the need to have cash on hand.

- A frozen exit environment observed since the start of 2022, along with cooling fundraising figures, has created a liquidity crunch in private markets. This liquidity crunch and the exit of SVB creates a unique opportunity for smaller private credit players to take up market share.

- Increasing levels of capital demand relative to supply will allow venture debt lenders to increase debt pricing.

- While credit underwriting has not changed much fundamentally, shifting valuation paradigms will renew the importance of taking a hard, realistic look at growth and profitability outlooks.

Impact of SVB’s Collapse on Venture Debt in Asia

Over the last decade, there were two major forays into India and China as SVB sought to expand its overseas footprint. In 2008, SVB formally launched a venture lending operation after having opened offices in Bangalore in 2004 and Mumbai in 2007. However, 7 years later, SVB sold its venture debt arm to Singapore’s Temasek who renamed the entity Innoven Capital India, part of the Innoven Capital Group.

While SVB retreated from India, it subsequently set up a joint venture in China with Shanghai Pudong Development Bank. SPD-SVB was launched in 2012 to help Chinese startups do cross-border business with the US and facilitate capital raising across both shores. This JV was jointly owned by both banks but operating with its independent balance sheet. It is reported that SPD is now considering acquiring the SVB subsidiary in China.

In Southeast Asia, while market talk was that SVB was keen to understand the venture debt landscape in the region, no concrete expansion or lending took-off here. Taking a leaf out of its China and India expansion challenges, SVB perhaps recognized that it might have been a relatively large undertaking for it to attempt to build an organic venture debt business in Southeast Asia and instead chose to mostly co-lend with reputable venture lenders active in the region.

Given its lack of presence in the region, SVB’s collapse has not had a significant impact in Asia as Asian start-ups did not have any real direct exposure to SVB. On the flip side, the collapse did spur many parties to reconsider their corporate and personal banking relationships. At its 1Q’2023 AGM, DBS CEO Piyush Gupta mentioned that Singapore’s largest bank has benefited from inflows amounting to a “few hundred million” in the aftermath of the collapse of SVB given the perception that DBS and Singapore were perceived to be “safer” banking havens.

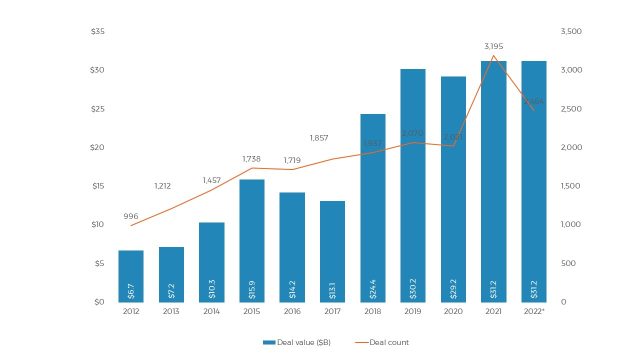

Figure 2: US VC deal activity (Source: Pitchbook)

Startup valuations are also retreating with mid to late-stage companies facing mounting pressure to justify high valuations while seed-stage deals have seen valuation moderately increase. ‘Tourist’ investors who joined the flurry of VC investing and injected capital into startups at eye-popping valuations are taking a more cautious view of deploying more capital into this sector.

The recent funding trend should not be used as a yardstick to measure the demand for innovative solutions to the world’s pressing challenges. Technology remains critical in addressing issues such as climate change, financial inequality, aging populations, and healthcare, which are projected to worsen in the coming years. As a result, sustained investment in innovative technologies is essential. Long-term venture investors with multiple funds can breathe a sigh of relief, knowing that the demand for their expertise and resources will remain high in addressing these challenges.

Going forward, startups will also need to recalibrate expectations. The liquidity crunch will add another layer of difficulty for venture-backed startups looking to raise equity rounds amid the ongoing macroeconomic headwinds. The days of limitless capital to fund “growth-at-all-cost” are no longer there. Venture investors are actively seeking out startups that can demonstrate profitability, and startups must adjust their strategies accordingly. Today’s startup pitches highlight a low burn with a long cash runway – redefining the metrics of an attractive startup to a venture investor.

The House View is reproduced from Genesis’ Limited Partners Quarterly Update. The content in this article is meant to be informative and for general purposes only. It is not and shall not be construed as investment advice.