Executive Summary

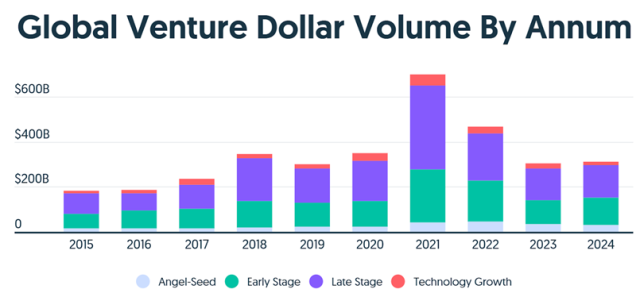

For years, Southeast Asia’s venture capital ecosystem faced a persistent critique: it was “rich in paper valuations but poor in liquidity.” The primary concern for institutional investors was the scarcity of exit opportunities, which resulted in a congestion of private capital that not only affects early investors and long-term employees but, crucially, limits capital recycling into the venture capital ecosystem for investment in the next big ideas.

In 2025, Southeast Asia experienced a progressive market correction, accompanied by a wave of strategic corporate acquisitions, secondary buyouts, and a resurgent IPO market, which boosted the region’s optimism for startup exit opportunities. The accelerated pace of liquidity events – specifically highlighting how global capital inflows are providing secondary exits to early vintage funds and public listing of startups could reinvigorate the investment scene in Southeast Asia.

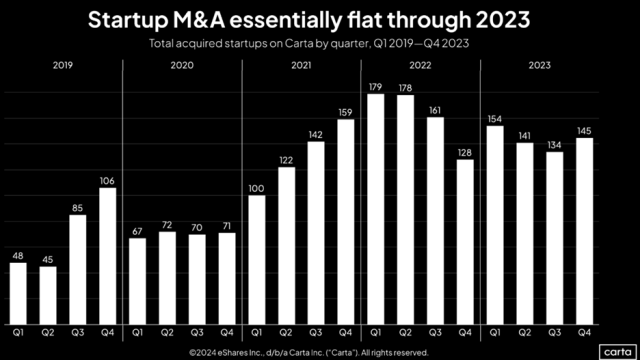

Merger, Acquisitions and Secondary Exits Lift VC Exits in Southeast Asia

The most significant trend in the final quarter of 2025 has been the definitive rise of secondary buyouts. As startups opt to stay private for longer, private equity funds are increasingly stepping in to purchase shares from early-stage venture capitalists. This mechanism is critical because it validates the asset class by returning essential cash to Limited Partners (LPs) without requiring a long, drawn-out public listing exercise.

The landmark deal of the year was Sociolla’s $250 million fundraise, led by General Atlantic, which consisted of primary and secondary capital in exchange for a majority controlling stake. Sociolla, founded in 2015, had rapidly grown to become Indonesia’s premier beauty shopping destination, offering customers a robust omnichannel, online and offline, experience. This deal not only marks General Atlantic’s entry into the Southeast Asian beauty tech market but also aligns with its strategy of investing in high-growth companies in emerging markets.

It was reported that the structure of this transaction was primarily through secondary share purchases, enabling the core objective of clearing cap tables. Crucially, this facilitated a complete or partial exit for Socialla’s institutional investors like Pavilion Capital, L Catterton, East Ventures, and EDBI. Some investors were reported to have fully exited their stake in the company while others chose to realize partial gains while retaining exposure to future upside. This deal structure allowed early investors to cash out, offered liquidity opportunities for founders and early employees holding vested equity, and also gave Socially an additional US$10 million primary capital injection for its next phase of growth.

This deal serves as a clear blueprint for 2026, proving that Southeast Asian “unicorns” and “centaurs” may not need to wait for a US IPO to generate returns. Global private equity giants are now willing to provide the liquidity required to clear the cap tables of early-stage VCs, thereby “unlocking” capital for reinvestment into the next cycle of startups.

Startups are not the only ones who are seeking liquidity; venture funds are also pursuing capital distribution back to their LPs. This GP-led secondary transaction involved an Indonesian-Southeast Asia VC fund, East Ventures, and a global secondary firm, Coller Capital, which underwrote the entire transaction. Through this transaction, East Ventures offered LPs in its East Ventures 5 fund (“EV5”), liquidity, bringing its total distribution-to-paid-in capital (DPI) to approximately 2.0x.

Strategic M&A: Global Giants Acquiring Regional Infrastructure

Beyond secondary buyouts, 2025 saw a sharp surge in trade sales, where global tech giants acquired regional players to secure immediate market and regulatory access, local infrastructure, or intellectual property. These full acquisitions provide 100% or majority liquidity to all shareholders, including angel investors and staff.

Airwallex Aggregates Indonesian Infrastructure

Fintech giant Airwallex, recently valued at US$8 billion and armed with a $330 million war chest, acquired a majority stake in Skye Sab Indonesia, a licensed payment provider. This acquisition provided an immediate exit for the Indonesian company’s original stakeholders. Instead of building its regulatory and operational presence from scratch, Airwallex utilized its massive Series G funding to acquire the necessary regulatory access and local infrastructure to serve Indonesia’s 64 million SMEs. This signals a clear “buy over build” strategy, which makes Southeast Asian startups in regulated sectors attractive acquisition targets.

Meta and the AI Exit

In a massive validation of Singapore’s deep tech ecosystem, Meta Platforms agreed to acquire the Singapore-based AI startup Manus. Manus, which was developed by Butterfly Effect and had early operations in Beijing and Wuhan, raised $75 million in funding from Benchmark before relocating its headquarters to Singapore.

Though financial terms were undisclosed, the deal was reportedly valued at over $2 billion, representing a massive win for Benchmark, the U.S. VC firm that led Manus’s earlier rounds. Meta plans to integrate Manus and its “agentic AI” technology into products like Meta AI. This technology is a natural fit for Meta’s fast-growing WhatsApp SMB footprint and supports a vision of personal AI that requires much less prompting than current AI chatbots. The deal is also notable as one of the first in which a major U.S. tech company has bought a startup with Chinese roots.

The speed of the Manus-Meta deal, which closed in just 10 days, was only possible because of a critical decision made months earlier: relocating from Beijing to Singapore. By the time Meta came knocking, Manus was already a Singapore entity, avoiding potential U.S. congressional hearings and last-minute friction around the transfer of AI talent and IP from the China side – a key lesson that incorporating in Singapore can be the difference between a swift close and an acquisition that never happens in today’s political climate.

Corporate-led Mergers and Acquisitions

Other significant exits highlight the diversity of acquirers and the increasing value placed on regional infrastructure and specialized tech:

- Grab’s acquisition of Infermove, a Chinese-founded robotics firm serving the likes of Meituan, Ele.me, and Sam’s Club, demonstrates that regional platform giants (Grab, GoTo, Sea) are also active consolidators. Grab Holdings acquired Infermove to enhance its last-mile delivery capabilities, and this exit validates the risk taken by early investors like MiraclePlus (formerly Y Combinator China) and a listed Chinese company, providing a viable exit path for smaller tech innovators.

- HEPMIL Media Group, a Singapore-based digital creator agency that connects brands to a network of over 1,000 creators across Southeast Asia and the parent company of SGAG, MGAG, and PGAG, was acquired by the French advertising agency Publicis Groupe. Multiple sources reported that HEPMIL’s early angel investors are walking away with 20x returns from their 2017 seed cheque, a rare exit in an otherwise quiet year.

- Mercedes-Benz completed the acquisition of a 3% stake, worth $191 million, in Chinese autonomous driving developer Chongqing Qianli Technology. This deal, following a strategic integration with Geely-backed Qianli Intelligent Driving, emphasizes a forward-looking technical direction focusing on a “high model ratio” approach – prioritizing algorithms and model generalization capability over expanding feature counts.

Southeast Asia’s IPO Revival: Public Market Validation

While private exits dominated 2025, the public markets have undeniably reopened, offering another crucial off-ramp for investors. The Singapore Exchange (SGX) recorded its strongest IPO performance in six years, raising over S$2 billion in 2025. Malaysia’s stock exchange, Bursa Malaysia, hosted 60 IPOs, up from 55 in 2024, collectively raising an estimated RM5.5 billion (approximately US$1 to RM4.06) in proceeds, with forecasts pointing to over 60 listings in 2026.

An achievement that reinforces the exchange’s position as one of ASEAN’s most active exchanges.

Singapore HealthTech listing of UltraGreen.ai

The public debut of UltraGreen.ai, a surgical technology firm specialising in Fluorescence-Guided Surgery (FGS), in December 2025 was a good showcase of what is to come. Backed by Singapore investors 65 Equity Partners and August Global Partners, the stock surged 11.7% above its IPO price on debut. With its offering oversubscribed 13.6 times, raising total proceeds of $400 million (including $237.5 million in cornerstone commitments from 16 global investors), the demand indicated a deep institutional hunger for high-quality, tech-driven assets. UltraGreen’s success illustrates a rotation of capital toward “hard tech” and healthcare, away from the consumer internet dominance of the past decade.

Listing Malaysia’s Digital Media Powerhouse

Penang’s digital publisher Foodie Media Bhd (KL:FOODIE) creates viral short-form videos and lifestyle guides for food, travel, and events. They own a wide network of brands including Penang Foodie, Singapore Foodie, and Johor Foodie. Foodie made a strong debut on the ACE Market of Bursa Malaysia, opening at an 18.3% premium to its IPO price. The IPO was reportedly oversubscribed by 24.63 times, raising RM41.4 million for the company and RM33.6 million for existing shareholders, including founder Nicholas Lim Pinn Yang.

Indonesia’s Digital Banking Goes Public

Indonesia also saw a major listing with Superbank (SUPA)’s IPO in December 2025 on the Indonesia Stock Exchange (IDX), which raised $167 million and was the nation’s second-largest IPO of the year. The digital banking firm, backed by Grab, Emtek, and Singtel, surged 24 per cent on its Jakarta debut, with the offering oversubscribed by more than 300 times. Their success boosted confidence in the digital banking sector and could inspire other Indonesian startups such as Traveloka and Kopi Kenangan to go public.

Looking At The Venture Capital Ecosystem Beyond 2026

The market activity of late 2025 is a good indication that the Southeast Asian startup ecosystem has matured. There are clear examples that startups and VCs are moving from a reliance on hypothetical future IPOs and toward a diverse “Exit Superhighway” with multiple, reliable offramps:

- Secondary Buyouts (e.g., Sociolla) for partial liquidity.

- Strategic M&A (e.g., Meta/Manus, Airwallex/Skye Sab) for full exits.

- Domestic IPOs (e.g., UltraGreen.ai) for public listings.

The landmark collaboration between SGX and NASDAQ will establish a dual listing bridge, offering Asian companies with a market capitalization of S$2 billion and above a direct and harmonized pathway to simultaneously tap into growth capital and liquidity across the U.S. and Asia. This move could fundamentally reshape the capital-raising strategy and investor base structure for leading Asian growth companies. Furthermore, the MAS is structurally uplifting the local equities market with a substantial S$5 billion programme aimed at shoring up liquidity and attracting deeper market participation. Small-cap (under S$1 billion) and mid-cap (S$1 billion to S$5 billion) stocks are particularly well-positioned to benefit from this initiative.

The robust 2026 outlook is fundamentally underpinned by the Singapore government’s unwavering commitment to de-risking and catalyzing deep tech ventures. The government has allocated a dedicated S$37 billion (approximately 1% of GDP) to its Research, Innovation, and Enterprise (RIE2030) Plan for the 2026–2030 period. These strategic investments will target “grand challenges,” such as longevity and semiconductors, ensuring a strong and continuous pipeline of future investable assets for the venture capital ecosystem. In addition, new initiatives, including the Activate Global-Singapore Fellowship, are specifically designed to empower scientists to commercialize their research. By effectively bridging the gap between academic discovery and venture-backable startups, Singapore is proactively cultivating a fertile ground for the next wave of deep tech champions.

This trove of acquisitions is the missing link that institutional investors have been waiting for. By returning capital to early investors and rewarding early employees, these deals could restore the confidence loop throughout the ecosystem and unclog the private capital bottleneck. As we enter 2026, we hope to see this recycled capital flow rapidly into the next generation of founders, sparking more to come forward and create a disruptive, competitive startup environment.

Imagine the startup ecosystem as a forest. For a long time, we planted many trees (startups) and watered them (capital inflow), but the forest was too dense because old trees rarely fell to make room for new growth. The recent wave of acquisitions and secondary buyouts acts like a selective harvest. It clears the canopy, allowing sunlight (liquidity) to reach the forest floor, nourishing the seedlings (new founders) and enriching the soil (investors) for the next cycle of growth.

This maturing “Exit Superhighway” is also becoming a fertile landscape for venture lenders like Genesis Alternative Ventures to play a pivotal capital provider role. As startups navigate these diverse exit paths, venture debt serves as a non-dilutive bridge to liquidity, allowing founders to optimize their balance sheets before an IPO or sustain growth during lengthy M&A negotiations. In an environment where strategic acquisitions and secondary buyouts are becoming the norm, venture lenders can offer flexible capital to bridge the gap between funding rounds or provide the necessary runway to reach a higher valuation milestone. For venture lenders, the increased clarity in exit outcomes reduces the risk profile of lending to mid-to-late-stage companies, creating a “win-win” where debt facilitates the scale required to reach these public or private off-ramps while protecting equity for the long-term.