GENESIS Alternative Ventures has raised US$125 million in a final close for its second venture-debt fund focused on South-east Asia. The majority of investors are returning investors from the venture lender’s first fund, including Sassoon Investment Corporation, Korea Development Bank, Silverhorn and Japan’s Aozora Bank and Mizuho Leasing. New investors in the second fund include Mizuho Bank and US-based investing platform OurCrowd.

For full Business Times article (10 September 2024)

Genesis Alternative Ventures, a private lender to ventures and growth-stage companies, closed its second debt fund at the lower end of its target as global investors remain cautious about Southeast Asia’s startup industry. The Singapore-based firm raised $125 million for the fund to finance young companies across Southeast Asia, securing new investors including Japan’s Mizuho Bank and Israel’s OurCrowd Ltd.

For full Bloomberg article (10 September 2024)

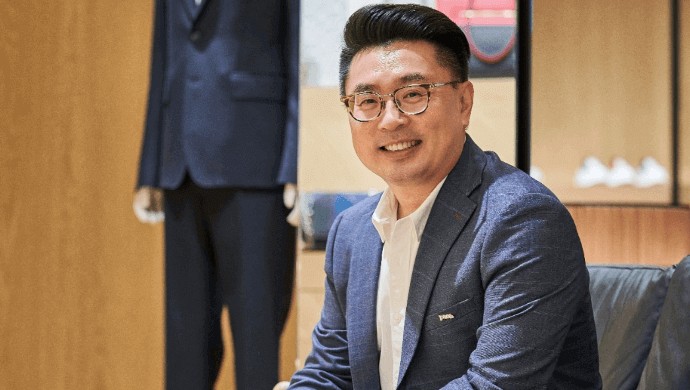

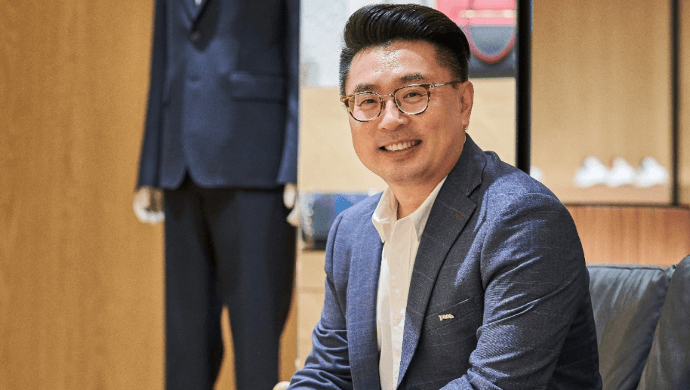

Singapore-based Genesis Alternative Ventures has raised $125 million in its latest fundraising round, attracting investments from global investors including Japan’s Mizuho Bank. The second Southeast Asia-focused venture debt fund has already deployed more than $20 million in loans to a handful of startups across the region, including in Singapore, Indonesia, Malaysia and the Philippines, according to Genesis co-founder and managing partner Jeremy Loh.

For full Market Watch article (10 September 2024)

Genesis Alternative Ventures, a private lender to ventures and growth-stage companies, closed its second debt fund at the lower end of its target as global investors remain cautious about South-east Asia’s start-up industry. The Singapore-based firm raised US$125 million (S$163 million) for the fund to finance young companies across South-east Asia, securing new investors including Japan’s Mizuho Bank and Israel’s OurCrowd. The fund had sought US$120 million to US$180 million, and took more than two years to reach the close.

For full Technode Global article (10 September 2024)

Genesis Alternative Ventures has raised US$125 million in the final close for its second venture-debt fund focused on Southeast Asia. The majority of investors are returning backers from the venture lender’s first fund. They include Sassoon Investment Corporation, Korea Development Bank, Silverhorn, Aozora Bank, and Mizuho Leasing. Japanese banking firm Mizuho Bank and US-based investing platform OurCrowd jump in as new investors.

For full TechInAsia article (30 Aug 2022)

Genesis Alternative Ventures raises $163m for SEA venture debt fund It has already deployed US$20m venture loans to start-ups across the region. Genesis Alternative Ventures raised a total of $163m (US$125m) for its second Southeast Asia-focused venture debt fund. According to Genesis, the fund saw 80% of its investors from the first round joining again, including Aozora Bank, Korea Development Bank, Mizuho Leasing, Sassoon Investment Corporation, and Silverhorn.

For full Singapore Business Review article (13 September 2024)

新加坡风险投资机构Genesis Alternative Ventures在最新一轮集资活动中,筹得1亿2500万美元(约1亿6328万新元)。Genesis Alternative Ventures(简称GAV)在星期二(9月10日)发表文告说,这轮集资活动是为第二个聚焦东南亚的创投债务基金(venture debt fund)筹资。其中80%的投资者也曾投资于第一个类似的基金。

For full Lianhe Zaobao article (10 September 2024)

Genesis Alternative Ventures, the Southeast Asian firm headquartered in Singapore, announced yesterday that it has raised total commitments of $125 million for its second Southeast Asia-focused venture debt fund. The firm’s Fund II entity saw the return of more than 80 per cent of investors from Fund I, including Aozora Bank, Korea Development Bank, Mizuho Leasing, and Sassoon Investment Corporation and Silverhorn. New and notable investors in Fund II include Japanese mega bank, Mizuho Bank, and OurCrowd, the online global investing platform.

For full Wealth Briefing Asia article (12 September 2024)

Genesis Alternative Ventures has raised US$125 million for its second venture debt fund, aimed at supporting Southeast Asian startups. The fund attracted strong interest from existing and new investors, including Japan’s Mizuho Bank and global investment platform OurCrowd. Returning investors from the first fund include Aozora Bank, Korea Development Bank, Mizuho Leasing, Sassoon Investment Corporation, and Silverhorn. Genesis’ collaboration with Indonesia’s Superbank, announced in August 2023, will provide up to US$40 million in venture debt to tech startups in Indonesia.

For full Fintech News SG article (11 September 2024)

Genesis Alternative Ventures, a Singapore-based private lender to venture, and growth stage companies funded by tier-one VCs, raised US$125m for its second Southeast Asia-focused venture debt fund. Fund II received commitments from over 80% of investors from Fund I, including Aozora Bank, Korea Development Bank, Mizuho Leasing, Sassoon Investment Corporation and Silverhorn. New investors in Fund II included Mizuho Bank, and OurCrowd, the online global investing platform.

For full VC Wire article (10 September 2024)

Genesis Alternative Ventures, an investment firm for startups in Southeast Asia, has successfully raised a commitment of $125 million or equivalent to Rp1,9 trillion for venture debt fund (venture debt fund) both of them. This fund will focus on investing in technology startups in the Southeast Asia region.About 80% of investors from the first fund returned to participate in the new fund, including Aozora Bank, Korea Development Bank, Mizuho Leasing, Sassoon Investment Corporation, and Silverhorn. New investors joining this time include Mizuho Bank, a major Japanese bank, and OurCrowd, another global investment platform.

For full Daily Social article (10 September 2024)

Genesis Alternative Ventures, Singapore’s private venture debt firm, has secured USD 125 million in commitments for its second fund, tapping into a mix of loyal backers and fresh faces. Over 80% of investors from the firm’s first fund—including Aozora Bank, Korea Development Bank, Mizuho Leasing, and Silverhorn—renewed their support, while notable newcomers like Mizuho Bank and global platform OurCrowd joined the fold.

For full KR Asia article (10 September 2024)

Singapore-based Genesis Alternative Ventures has raised $125 million in its latest fundraising round, attracting investments from global investors including Japan’s Mizuho Bank. The second Southeast Asia-focused venture debt fund has already deployed more than $20 million in loans to a handful of startups across the region, including in Singapore, Indonesia, Malaysia and the Philippines, according to Genesis co-founder and managing partner Jeremy Loh.

For full Barrons article (10 September 2024)

Singapore-based venture capital firm Genesis Alternative Ventures has raised total commitments of $125 million for its second Southeast Asia-focused venture debt fund. Fund II welcomes back over 80 percent of investors from Fund I, including Aozora Bank, Korea Development Bank, Mizuho Leasing, Sassoon Investment Corporation and Silverhorn, Genesis said in a statement on Tuesday. According to the statement, new and notable investors in Fund II include Japanese mega bank, Mizuho Bank, and OurCrowd, the online global investing platform.

For full Tech Node Global article (10 September 2024)

Genesis Alternative Ventures, a private lender to ventures and growth-stage companies, closed its second debt fund at the lower end of its target, as global investors remain cautious about Southeast Asia’s start-up industry. The Singapore-based firm raised US$125 million (RM544.69 million) for the fund to finance young companies across Southeast Asia, securing new investors, including Japan’s Mizuho Bank and Israel’s OurCrowd Ltd. The fund had sought US$120 million to US$180 million, and took more than two years to reach the close.

For full The Edge Malaysia article (10 September 2024)

Genesis Alternative Ventures, a private lender to ventures and growth-stage companies, closed its second debt fund at the lower end of its target as global investors remain cautious about Southeast Asia’s start-up industry. The Singapore-based firm raised US$125 million ($163.14 million) for the fund to finance young companies across Southeast Asia, securing new investors including Japan’s Mizuho Bank and Israel’s OurCrowd. The fund had sought US$120 million to US$180 million, and took more than two years to reach the close.

For full The Edge Singapore article (10 September 2024)

Singapore-based Genesis Alternative Ventures has raised US$125 million for its second Southeast Asia-focused venture debt fund, known as Fund II. This new fund is aimed at supporting start-ups across the region, particularly in sectors poised for growth. Over 80% of the investors from the company’s first fund have returned for Fund II, including prominent institutions Aozora Bank, Korea Development Bank, and Sassoon Investment Corporation. New investors include major Japanese financial institution Mizuho Bank and OurCrowd, an online global investing platform.

For full The Asset article (10 September 2024)

Genesis Alternative Ventures, a private lender to ventures and growth-stage companies, closed its second debt fund at the lower end of its target as global investors remain cautious about Southeast Asia’s startup industry. The Singapore-based firm raised $125 million for the fund to finance young companies across Southeast Asia, securing new investors including Japan’s Mizuho Bank and Israel’s OurCrowd Ltd. The fund had sought $120 million to $180 million, and took more than two years to reach the close.

For full Yahoo article (10 September 2024)

Genesis Alternative Ventures, a Singapore-based private venture debt firm, has secured $125 million in commitments for its second fund, drawing on a mix of loyal backers and new faces. More than 80% of the firm’s first fund investors—including Aozora Bank, Korea Development Bank, Mizuho Leasing, and Silverhorn—renewed their support, while notable newcomers like Mizuho Bank and global platform OurCrowd joined the ranks.

For full Solondais article (10 September 2024)

[마미뉴스] 이서영 기자=Genesis Alternative Ventures가 최근 수십억 원 규모의 두 번째 채무 펀드를 조성했다. 이는 동남아시아 스타트업 업계에 대한 글로벌 투자자들의 신중한 태도가 계속되는 가운데 이루어진 성과다. 해당 펀드는 1억 2천 5백만 달러를 모금하면서 마무리됐다. 이는 계획했던 1억 2천만 달러에서 1억 8천만 달러 사이의 목표 금액 범위의 하한선에 해당한다. 싱가포르에 본사를 둔 이 펀드는 일본의 미즈호 은행과 이스라엘의 아워크라우드 등을 새 투자자로 확보했다. 펀드 모집은 2년 이상의 시간을 요구했다.

For full Solondais article (10 September 2024)

Singapore-based Genesis Alternative Ventures announced on Tuesday that it has closed its second Southeast Asia-focused venture debt fund securing commitments of $125 million. Dr Jeremy Loh, Genesis’ co-founder and managing partner, said they have already started deploying venture loans worth over $20 million from Fund II to startups across Singapore, Indonesia, Malaysia, and the Philippines.

For full DealStreet Asia article (10 September 2024)