Our Partner and co-founder, Ben J Benjamin answers some frequently asked questions about venture debt from start-up founders.

1. Who is venture debt for?

Venture debt is ideal for early-stage venture-backed companies that are growing rapidly and that need working capital to fund further expansion, undertake new projects, or acquisition. The key benefit is that founders (and other early investors) do not have to give up as much of their ownership in a funding round. In effect, venture debt can empower growth while minimizing equity dilution.

My colleague, Eddy Ng, shares how to structure your debt for success here: Deal Structure for Venture Debt Success

2. What about interest rates? And collateral?

In terms of payment, founders must consider the following two components:

- Interest: usually a flat rate of about five to eight percent

- Warrants: comprises about 15 to 25 percent of the loan quantum.

Given the nature of a startup’s business, very few of them have any collateral to pledge to the loan agreement. Unlike banks, venture debt lenders will not ask for personal guarantees or collateral. Instead, lenders will ask for warrants and include covenants to ensure repayment.

3. What are the typical payment terms?

The loan usually has to be repaid within 36 months, fully amortized. The warrant is separate from the loan. Depending on the company’s lifecycle or nature of business, the warrant period can be anywhere between five to 10 years. The venture lender would be free to exercise the warrant during this period.

4. Can I buy back my warrants?

In most cases, the buyers of warrants are usually the founders and/or their existing investors. While the stakes are not huge – warrants generally represent a maximum of two percent of the company – it is a good opportunity for such parties to increase their stakes before a liquidity event (such as an M&A, IPO, or trade sale, for example).

5. My start-up is constantly approached by venture funds. Why should I consider venture debt, even though the interest rate is not much higher than banks?

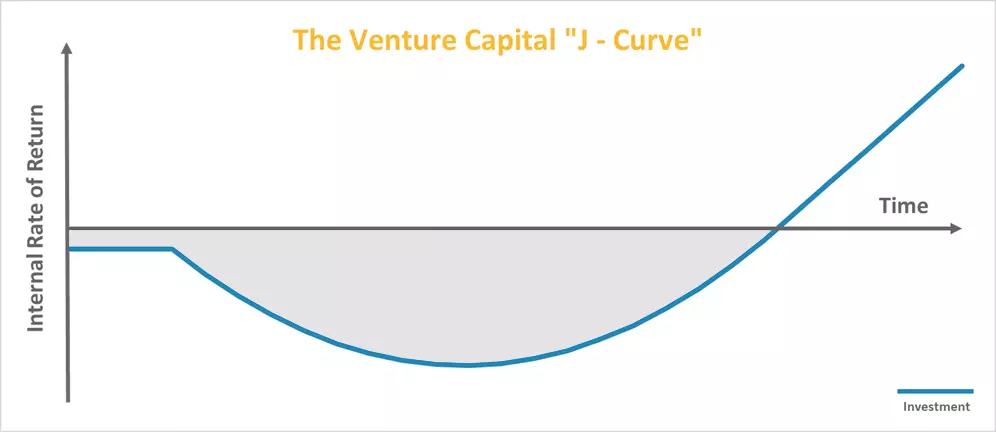

When raising funds, the key issue that entrepreneurs and investors alike face is equity dilution.

Just imagine if you could raise 20 to 30 percent of the entire series in less dilutive debt. (There is minimal dilution as the warrants may be exercised at some future date when the company is successful, as pointed out above in #4.)

Instead of taking that 20 to 30 percent equity dilution at the early stages of the company’s growth, it makes sense to use venture debt to minimize dilution, especially if you have the conviction that the business will increase in value over the long term.

6. As an entrepreneur, I can go to my existing equity investors and raise convertible notes. Why should I consider venture debt?

Many founders ask this question. A convertible note is generally converted into equity when the business performs well. So, it is not less dilution – it is just delayed dilution. And that dilution is 1:1; in the final analysis, it feels like full equity dilution.

7. Venture debt funds add little value to entrepreneurs.

There is a misconception that venture debt funds exit from the start-ups as soon as the loan is repaid. However, the reality is that venture debt funds do have skin in the game. As warrant holders, we are very much interested in the long-term success of the company. In fact, several of our portfolio companies have returned to us for additional debt because they enjoy the benefits of our experience, networks, and value-add.

8. I like the idea of minimizing equity dilution. Can I use 100% debt to fund my business growth?

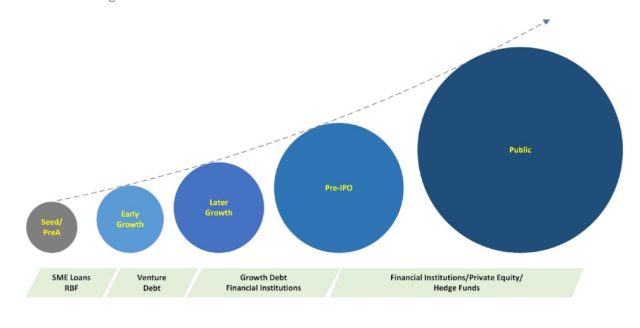

As with any company, a balanced capital approach is important when building your books. Just as we would say there is a space for venture debt on the balance sheet for early, high-growth tech companies, it would be unrealistic to suggest that debt should take up the lion’s share in the growth journey.

Venture debt is just one of the many options available for businesses. There are many tools for fundraising, so pick the most appropriate one in the context of your existing capital structure, shareholding, and business plans.

9. When is the right time for start-ups to use venture debt?

Timing is everything. A company that is too young (with poor cashflows, or without a strong balance sheet) will find it difficult to raise venture debt. A company that already has a capitalization table with good investors on board, and has either a strong balance sheet or strong cashflows, will find it easier to raise venture debt from a well-known lender.

It is also worth considering raising venture debt in conjunction with an equity raise. This allows the company to access additional cash to extend the runway to help achieve a larger milestone and a higher valuation at the next round of financing.

10. Any advice for founders when approaching venture debt providers?

We appreciate founders who are honest and forthright from the start. The journey to build a successful business will take three-, five-, or 10-years, so mutual trust is very important.

So, start a conversation with a venture debt provider, even before you need to raise debt. Take time to understand how venture debt works, and the key terms that come with it. Help us understand your industry, business model, and plans. This will accelerate the process when you are ready for venture debt.

Finally, choose your venture debt partner with care. Many founders focus their venture debt conversations on price and loan quantum. They should also consider choosing a venture lender who can be a long-term funding partner, and ask important questions such as, “Am I dealing with a venture lender who understands how a start-up grows and can the lender add value?”, “What is their track record of working with companies that hit hard times?”, and “Will they take a long-term perspective?”.

If you have any additional questions, please do reach out to Ben.