In December 2024, Aubrey Tan completed a full-time internship with us at Genesis Alternative Ventures. Her time was focused on gaining hands-on experience and learning about the venture debt industry.

We asked her to share her insights on her time with the firm, offering a useful perspective for students interested in a career in alternative finance.

—

Genesis [G]: What initially drew you to Genesis Alternative Ventures?

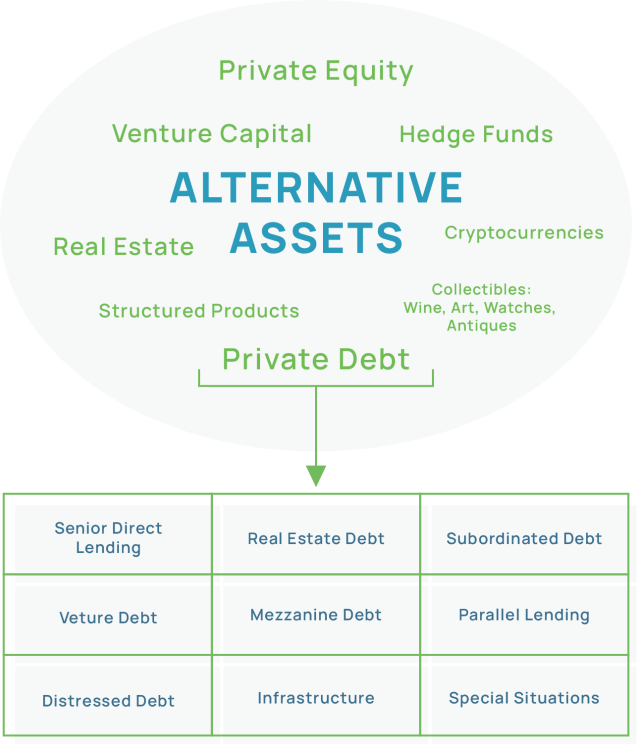

Aubrey [A]: What drew me to Genesis was the focus on venture debt. I was interested in the VC industry, but there are very few firms that specialise in venture debt, so it was a unique opportunity to gain first-hand experience.

[G]: What was the interview process like?

[A]: The interview process was straightforward and consisted of two rounds. The first was with the Talent Manager to get to know each other and the firm. Then I was interviewed by the Managing Partner, Jeremy, where I shared an investment case study.

[G]: Did your experience align with your initial expectations?

[A]: When I joined, my main expectation was to be involved in deals and assist with the actual deal process, and that expectation was definitely met. I was staffed on two deals quite soon after I joined, which gave me a lot of exposure to different work streams. The experience of being able to really push myself aligned with what I was hoping for.

[G]: What was the learning curve like for you?

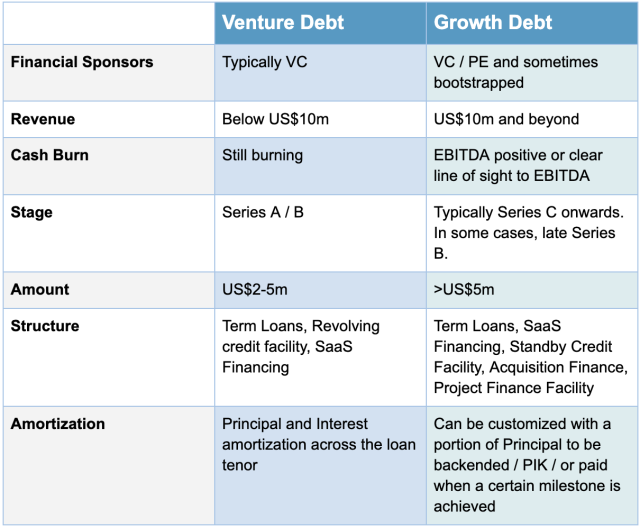

[A]: The learning curve was manageable, but it depends on your prior exposure to venture capital or investments. What really helped was that Jeremy organised regular sessions with the interns to explain what venture debt is, why we do certain things, and to demystify termsheets. We also had a structured onboarding process and a glossary of investment terms and concepts, which was helpful when you first join and might be unsure of what you do not know.

[G]: Can you describe a project or task you worked on that was particularly challenging or rewarding?

[A]: One of the most challenging things I worked on was a deal for a biotech startup focused on early cancer detection. It involved a lot of technical jargon, which required a learning curve to understand the technology and how it created value. It was also rewarding because beyond just analysing the financials, I felt we were doing something meaningful by providing them with capital.

[G]: What was the company culture like?

[A]: The team was very willing to give me opportunities and trusted me with responsibilities that were central to the success of deals. As an intern, I supported due diligence and prepared the first-cut list of questions for startups we were screening.

Before meetings with founders, the senior team members would take the time to review the questions with me and encourage me to verbalise my views, discussing next steps and providing valuable feedback for refinement. The team also brought me into meetings with founders, which was great because I could see my contributions in action.

Beyond work, there’s a strong team spirit. We often had lunch together and celebrated birthdays, so I felt truly integrated in the team.

[G]: Having been through the program, what advice would you give to an undergraduate considering an internship at Genesis?

[A]: My advice would be to have clear goals for the internship. At a dynamic firm like this, it’s easy to get caught up in the deals. If you have clear goals, it helps you take the initiative to ask people to teach you what you want to learn. People here are very willing to teach you, but you have to take the first step and communicate what you want.

[G]: What was the most surprising thing you learned about the venture debt industry or about yourself during your time here?

[A]: The most surprising thing for me personally was how much I really enjoyed working on investments. Previously, my internships were more consulting or advisory-related, so I had not had prior direct exposure to deal execution. The team was very supportive and gave me the exposure to try more technical aspects, which helped me realise that this is something I am very interested in.

[G]: If you had to sum up your entire internship experience in just three words, what would they be?

[A]: The three words would be “Learning,” “Enriching,” and “Supportive”. I’m very thankful that, despite it being my first investment internship, the team didn’t treat me as just an intern, but was open to letting me try different things and giving me live transaction experience. The team is incredibly supportive, and there is always something to learn, which makes the experience enriching.

—

Aubrey’s journey shows what it’s like to be an intern at Genesis Alternative Ventures. Our interns get hands-on experience working on live deals and are never left to flounder—the team is always there to guide. We’re grateful for all the dedication she put into the deals that she worked on. We wish her the best in her future and know she’ll do great things.