Christopher Yap: From Intern to Associate

What does it take to go from a curious intern to an Investment Associate in the dynamic world of venture capital? Meet Christoper Yap.

Chris started as an intern with Genesis in June 2022. He was hired as a full-time investment analyst upon graduation from the Singapore Management University as a Finance and Banking major. Since then, his passion and drive quickly propelled him through the ranks, leading to his promotion to Senior Analyst in July 2024 and, most recently, to Associate in July 2025.

We caught up with Chris to uncover the experiences that have shaped his exciting career journey so far.

Genesis [G]: Hi Chris, please tell us more about yourself.

Chris [C]: I’ve always had a keen interest in finance, investments, and entrepreneurship. My ultimate goal is to be an entrepreneur, starting a company and growing it while helping to improve the lives of others.

Outside of work, I am an avid basketball fan, watching the latest games or classic match-ups of the 1990s. I also enjoy football, golf, hanging out with friends, reading and watching movies, or trying out new experiences and challenges.

[G] At university, you majored in Finance and Banking. What prompted your choice?

[C]: I’ve always been interested in Finance from a young age. I first started investing in stocks in secondary school, and I really enjoyed figuring out the story behind the numbers. Things like: why did a company’s sales improve? How would the macroeconomic environment affect them? What’s their value proposition against competitors? I loved forming my own thesis based on the information I gathered.

The diverse and dynamic nature of Finance was very engaging and exciting to me, allowing me to tap into different skill sets and see the interlink between business, finance, and economics.

[G]: Please describe your typical workday, if there is such a thing!

[C]: There is no such thing as a typical workday! The amount of innovation out there is amazing, especially in the tech industry. It is dynamic and constantly evolving, and there is always something new to learn every day!

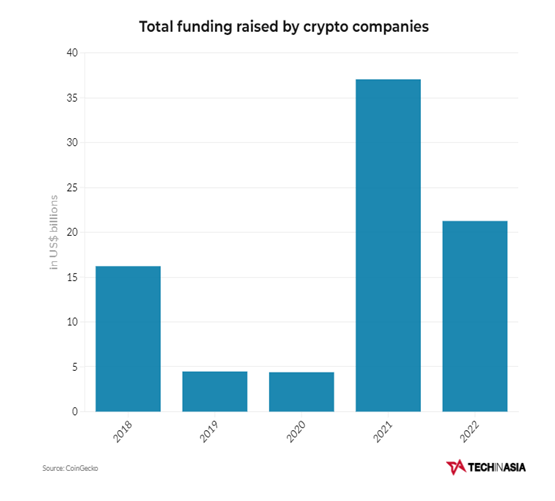

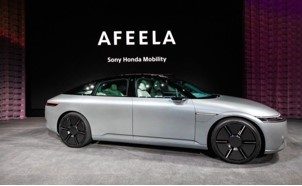

The fast-paced environment keeps me constantly engaged, while on slower days, I research emerging industries and technologies, or topics which I am particularly intrigued by, such as Artificial Intelligence (AI), Blockchain, Crypto, Metaverse, or Mixed Reality (XR).

[G]: What was your internship experience like at Genesis and what prompted you to accept the offer of a full-time analyst role?

[C]: I initially joined Genesis with no experience in the venture debt/capital industry. However, the team was very open and willing to guide and mentor me.

Being an intern at Genesis is great if you’re inquisitive and enjoy working in a dynamic and fast-paced environment. As long as you take initiative and ask questions, the seniors—including the Partners—are more than willing to teach you.

Interns have the opportunity to take on higher-level responsibilities, such as being involved in a deal from origination to execution, attending networking events, talking to startup founders, undertaking financial modelling and due diligence, and culminating with a presentation to the Investment Committee (IC) for approval.

Genesis places a strong emphasis on learning and development, where the team members take turns to their experiences, be it during weekly discussions or through masterclasses.

Besides working hard, the team knows how to have fun too! For one of our Bonding Day, we went for a short hike, raced each other in the Luge at Sentosa, and ended off with a durian buffet! When overseas travel opened up, the team went on a trip to Penang, taking in the sights and eating a lot of delicious food.

The dynamic and challenging nature of venture debt investing, coupled with the positive culture at Genesis and the opportunity to further develop myself prompted me to accept the conversion offer and continue my journey with Genesis as a full-time member of the Investment and Portfolio team.

[G]: What advice would you give to undergraduates who are seeking an internship in Genesis or any VC firm?

[C]: There is no defined path into the VC space, and that is what makes it so exciting in my opinion! You will have the opportunity to work with professionals from diverse backgrounds and learn from them. Start developing your soft skills and build meaningful relationships with professionals within the VC ecosystem. You’ll find that most are willing to give advice and share their personal experiences.

The VC space is fast-paced, dynamic, and constantly evolving. This means that an aspiring venture capitalist should be comfortable being uncomfortable, pushing themselves out of their comfort zones, and being able to adapt and work in an unstructured environment.

A strong technical foundation is a good starting point. This includes learning to build financial models, understanding business models, financial statements, valuation, and so on. But it’s just as important to back our technical skills with an inquisitive and open mind, and to dig deeper into the story behind the numbers.

[G]: Finally, congratulations on your promotion to Associate, Chris! How do you feel about this next step in your career at Genesis?

[C]: Thank you for the recognition. I am grateful for the mentorship and guidance from the Partners, and the support from the team who have helped me achieve this milestone. I look forward to continuing to grow and develop myself, striving towards the next milestone in my career.